Backtest results now for all past data

The hypothetical backtest results on the website have always gone back 5 years from the current month. This was to provide consistency when comparing systems and portfolios and to focus on more recent results. A common request received is how performance would have been in 2008. To answer that request and to provide as much historical data as possible (full transparency), all performance results have been updated to go back as far as possible. Results now go back to 2008 for the Index Trader portfolios, 2006 for the FedSwing systems and Index Swing portfolios, 2003 for MeanSwing II EMD & TF and 1999 for MeanSwing II ES.

To see these updated results, please go to http://trendfindertrading.com/.

Want to develop your own trading systems?

Would you like to develop your own trading systems? Trendfinder provides fully automated trading systems for your use, and I know that some of you also use your own trading strategies (or would like to create your own). If you have attempted to develop trading systems and trade them in real-time, you likely know how difficult it is to create systems that make profits in real time with real money. Just as you would go to college and/or get training to be successful in your career, you need to do the same to be successful in trading. Someone I recommend for this training is Alex Krishtop.

Alex Krishtop runs Edgesense Solutions, a boutique firm that specializes in consulting, development of trading strategies and education. Although I have not taken any of his courses or used his trading programs, I very much respect his work based on what I have seen through presentations and his contributions in LinkedIn discussion groups.

For beginners to system development the GoSystematic course covers all the basics of systematic trading. More information about it can be found at http://gosystematic.com.

For more extensive education there is a unique program which covers all stages of research and development – from exhaustive market analysis through understanding of the reasons why market prices move to simple algorithms that can be used right away with many popular trading platforms including TradeStation and MultiCharts. You can read more about this program at http://edgesense.net/education. This program is also the ideal choice for those that they may want to work on any topic as much time as required, and therefore it takes from 4 to 6 months depending on the student’s desire to learn any topic in-depth.

Besides education Edgesense Solutions offer ready made trading programs, mostly for currencies (forex), but also for some futures. You can use them as templates for your own strategies or just trade them as is. Also they offer Edgesense Research Frameworks – a unique development technology to semi-automatically create portfolios of trading strategies. More information can be found at http://edgesense.net/products and http://edgesense.net/research.

Please feel free contact Alex through the links above (let him know I referred you) or contact me for any questions you have!

FedSwing EMD no longer being reported

Since the end of November 2014 FedSwing EMD has not been used in any portfolios. Since FedSwing EMD has not been offered for individual subscription since the summer of 2014, it is no longer in any portfolios, and FedSwing II offers a better system (in my opinion of course), performance results for FedSwing EMD will no longer be posted. For those still trading FedSwing EMD I recommend switching to FedSwing II ES/NQ/TF.

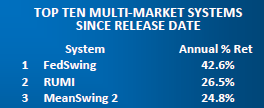

Futures Truth Rankings Update

I received the latest issue of Futures Truth Magazine today. FedSwing continues to have the #1 ranking and MeanSwing II is #3 for multi-market systems since release date. Even with the drawdown these systems have had they are still the top ranked systems.

Results above are through October 31, 2014. Futures Truth hypothetical percentage returns are based on “Min. Req. Cap.” which they calculate as 5 times Margin. Returns include $25 round turn for commission and slippage per trade. Please see the current Futures Truth magazine for more information.

FedSwing II

FedSwing II subscriptions are available for trading in the ES (S&P 500), NQ (Nasdaq 100) and TF (Russell 2000) futures. In comparison to FedSwing, FedSwing II incorporates the Fed’s open market account holdings and adds a break-even type of stop.

The website has been updated to include FedSwing II ES, FedSwing II NQ and FedSwing II TF. Due to low liquidity of the EMD (S&P MidCap 400), FedSwing II EMD will not be available as an individual system (allotments are reserved for the larger portfolios). The same applies to FedSwing II YM (Dow). FedSwing II NQ has been added as an individual system because the NQ has great liquidity.

All portfolios now use FedSwing II instead of FedSwing. This is because I think FedSwing II much better tracks the activity of the FOMC and will therefore provide better performance going forward. For comparisons of FedSwing to FedSwing II please see this blog post.

FedSwing II performance comparisons

FedSwing II has been released. FedSwing II incorporates the Fed’s open market account holdings. This additional filter reduces net profit historically, but more importantly it also reduces drawdown. In my opinion FedSwing II is better suited to FOMC policy, especially going forward, because it incorporates the balances of the FOMC’s open market holdings. Per the October FOMC statement where they announced the end of QE, they also stated that intend to remain accommodative by “reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction.” Translation: even though they are not engaging in new quantitative easing, they are still supporting the market.

Also a break-even type of stop was added because this is one of the most common requests received from clients and does not greatly hinder performance. The other two most common requests are smaller stops and trailing stops (both of which greatly degrade performance so were not added). Although this break-even stop does reduce profit a little, it will protect us from situations where we have a large profit and a price shock occurs.

Effective yesterday (11/24/14) all portfolios are using FedSwing II instead of FedSwing. Clients may continue to trade FedSwing on individual markets or switch to FedSwing II. To switch please contact your broker (may need to sign paperwork) and let me know so I have an accurate count. Please note FedSwing II will NOT be offered as an individual system for EMD because liquidity is too low.

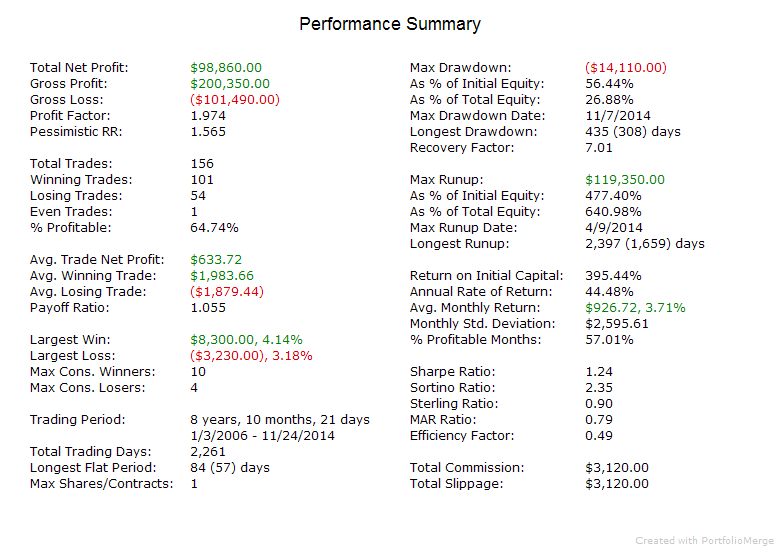

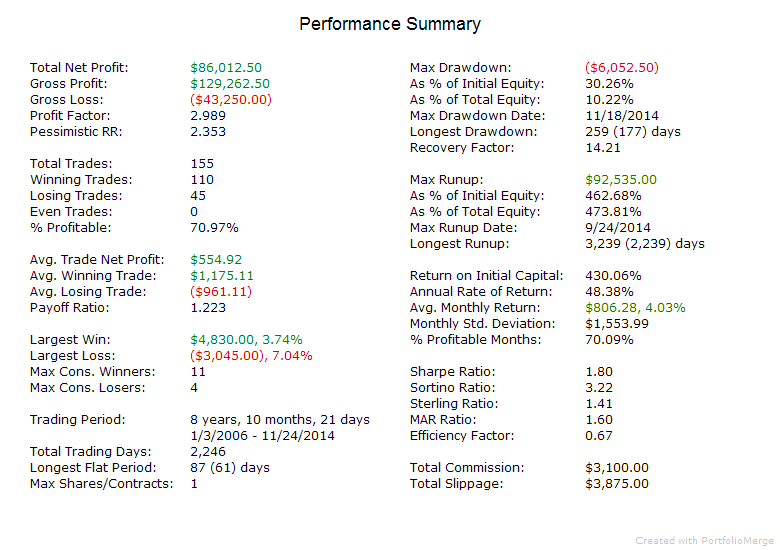

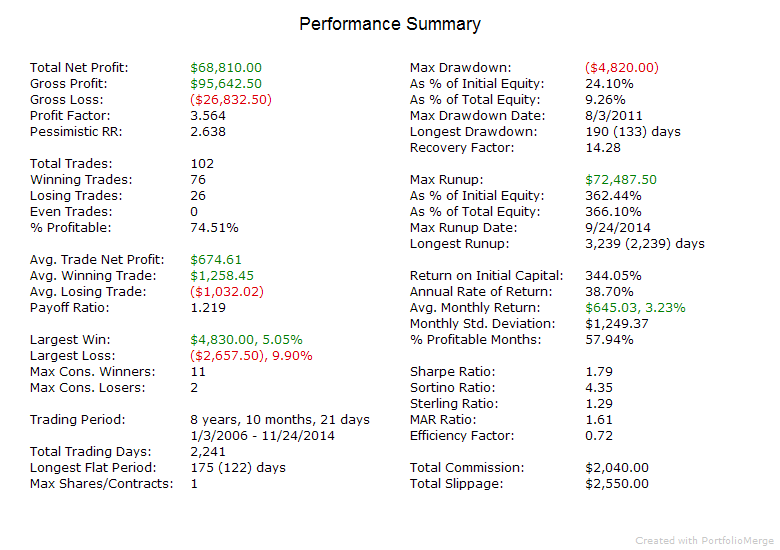

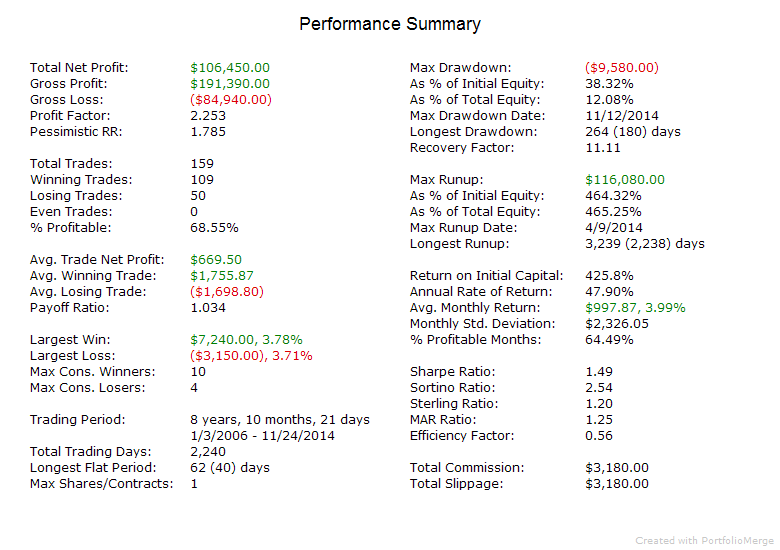

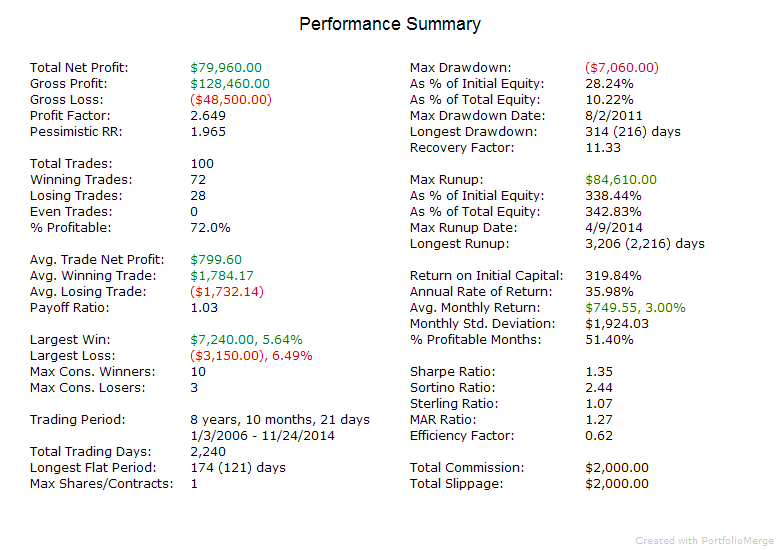

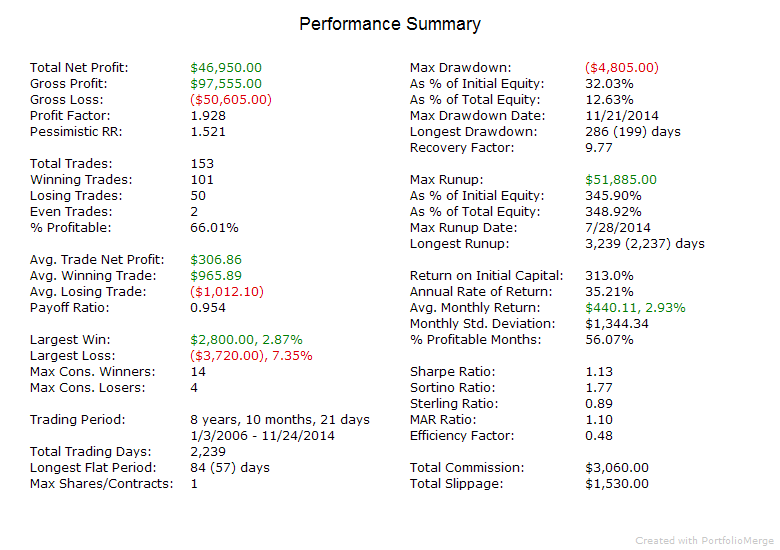

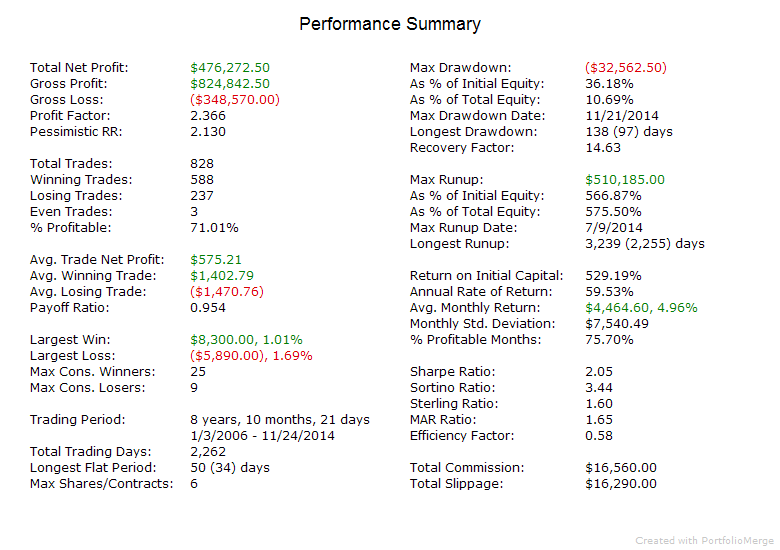

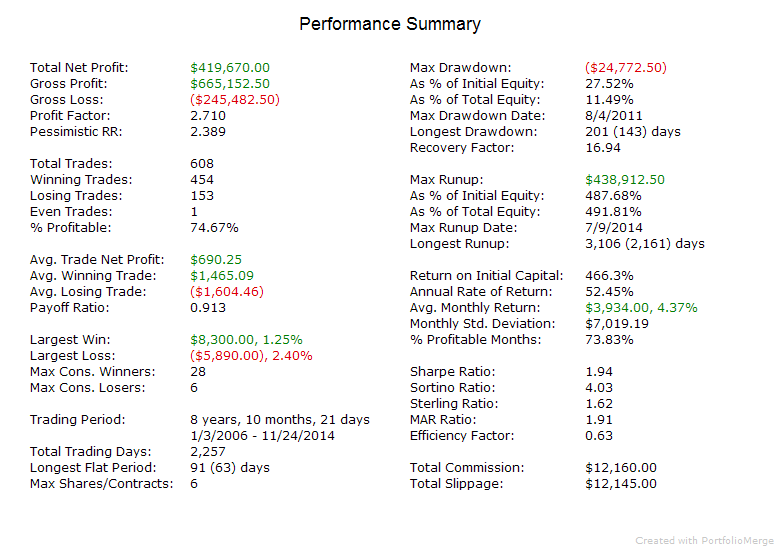

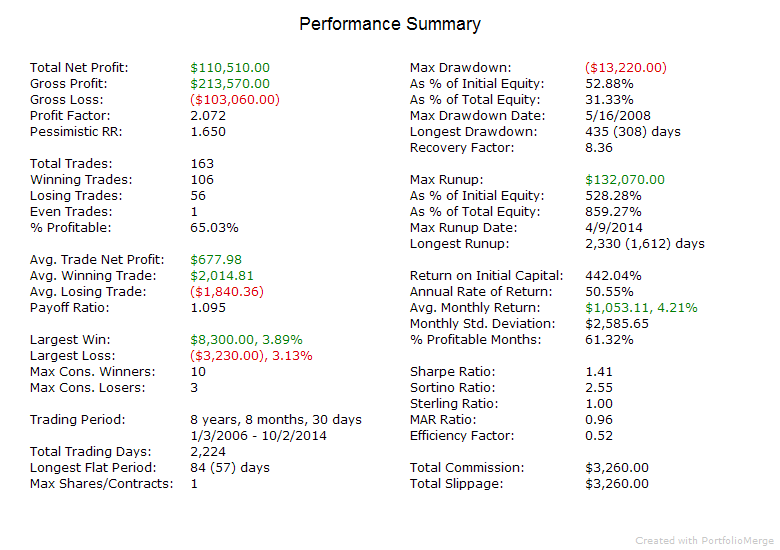

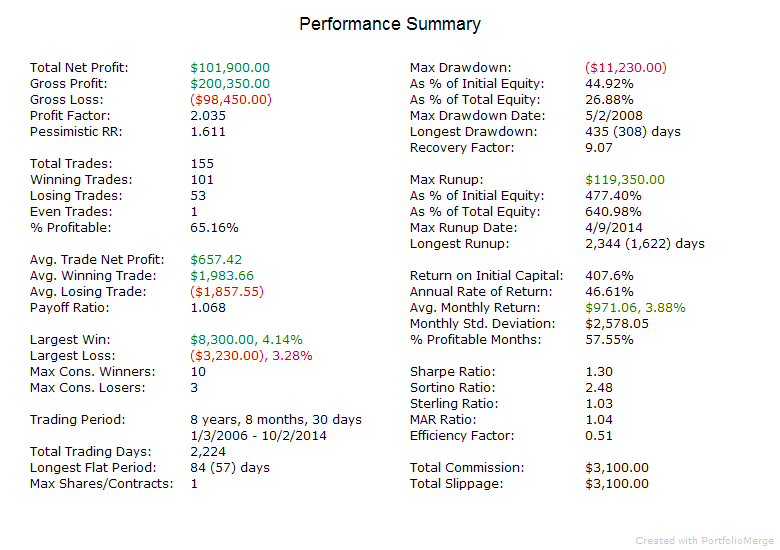

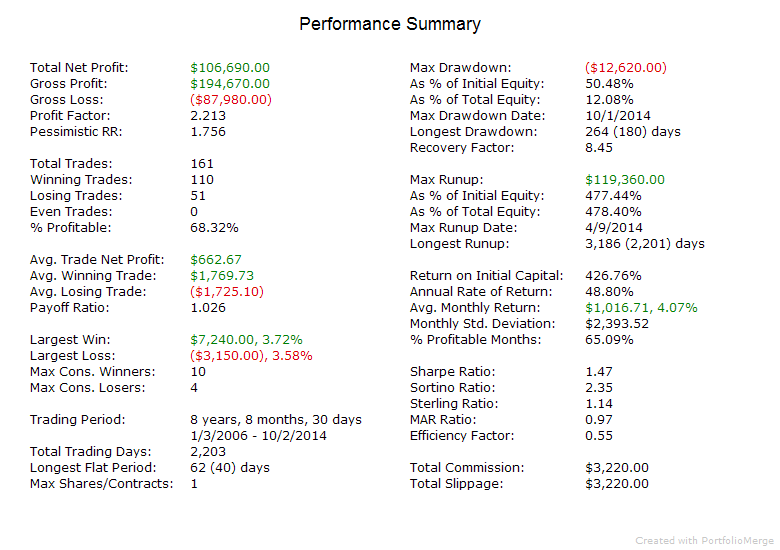

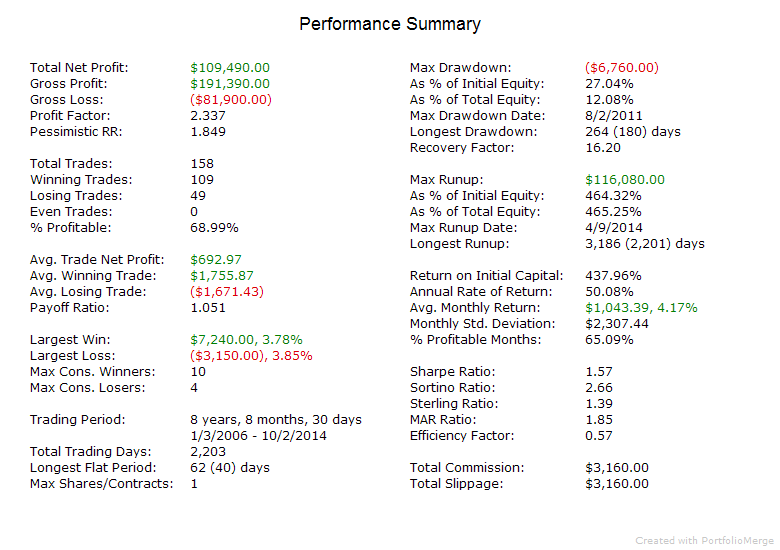

The performance reports following use the current version of FedSwing (with revision made in early October) applied to all data to give an apples to apples comparison going forward. For the Index Trader portfolios I used the current version of the Vol systems for all past data for the same reason. All hypothetical performance below includes $20 roundturn commission and 2 ticks roundturn slippage (3 ticks roundturn slippage for intraday systems). Reports were created going back as far as possible for systems used (FedSwing can go back to 1/1/06, Vol systems can go back to 1/1/07) so you can see as much info as possible. Below are summaries for FedSwing, FedSwing II, Index Swing 6 Portfolio and Index Trader V Portfolio. For full reports of all systems and portfolios, please download this zip file: Reports

FedSwing EMD current

FedSwing II EMD

FedSwing ES current

FedSwing II ES

FedSwing TF current

FedSwing II TF

FedSwing YM current

FedSwing II YM

Index Trader V current

Index Trader V with FedSwing II

Index Swing 6 current

Index Swing 6 with FedSwing II

For full reports of all systems and portfolios, please download this zip file: Reports

Next week I will update the website for FedSwing II and updated portfolios.

Update for FedSwing and commentary on performance

I discovered a minor tweak today that reduces losses for FedSwing. Instead of just waiting more than 3 days after a stop out to enter a trade in the same direction, it will now also require price to have reached an exit signal (MeanSwing already requires this). This simple revision has a very small effect on overall profit yet provides much better risk control. I am applying this as a walk forward update – all performance reports will use this updated version starting tomorrow. If you would like to see backtest results utilizing this update on all past data (1/1/2006-present) you can download the reports here. The two markets this update has the biggest effect on are the EMD (S&P MidCap) and the TF (Russell 2000). Comparative performance summaries are shown below.

FedSwing EMD

FedSwing EMD Updated

FedSwing TF

FedSwing TF Updated

Performance for many swing systems has been poor recently. The primary reason is that the strong bull market has lost steam. We aren’t getting the bounces from pullbacks that we were getting. Since we are still in a bull market by most measures, the swing systems have been taking mostly long trades. That appears to be changing.

The S&P 500 and Dow are the strongest of the markets the swing systems trade. The large caps have stayed well above their 200 day moving average but have been going sideways the last two months or so. Therefore the long swing trade results have not been as good as previous years but still doing okay for the S&P 500 and Dow.

The Russell 2000 has clearly been lagging and is under the 200 day moving average. This means it is very possibly starting a bearish trend. Since the trend has been rolling over the swing systems have had poor results for the Russell 2000. Going forward MeanSwing II TF will primarily be taking short trades on the Russell 2000 unless it moves back above the 200 day moving average.

The S&P MidCap is just below the 200 day moving average. A large bounce up from here may maintain its bullish trend, but if it declines further over the next few weeks it will be in a bearish trend. Because its bullish momentum has faded, the long swing trades have underperformed. If it continues to stay under the 200 day moving average MeanSwing II EMD will be mostly taking short trades.

I have spent lots of time the past two months testing different swing systems, different parameters for the existing systems, and different combinations. Nothing has significantly improved results compared to what is already being used (however the FedSwing update described above will reduce risk going forward). Basically what I’ve found is that what is being used is still working, and we just are in the unfortunate situation of a relatively large drawdown due likely to the markets rolling over from a bull to a bear. I am in a large drawdown in my own account too (I use the same strategies) so I know the pain.

One change I made to the intraday systems at the end of July has paid off. They have mostly avoided the poor intraday trading conditions the past two months.

My opinion about what the future holds is as follows. I think a bearish trend will start when Quantitative Easing comes to an end (which may be as soon as November). However, the top may already be in with people preparing for the end of QE and due to the effects of tapering. With the money pump turned off, the markets will likely move even freer than now and volatility will rise. As volatility increases, the intraday systems will become more active and should start providing profits again. The swing systems may struggle a little until we are fully turned over into bear mode. However they may do fine since they already have the potential for some short trades in October in addition to long trades.

Intraday systems update

I have completed an update to the intraday systems which will be effective starting tomorrow August 1. Overall they will take fewer trades when volatility is below the historical average (measured by the VIX).

Comment about performance of intraday systems

The performance of the intraday systems has eroded to the point I will likely be revising them. I have not made any revisions in over two years. This is because, although conditions have been poor (low volatility) the systems were still working (even losing systems can be within expected performance). I also thought volatility would be picking up with the Fed tapering and Quantitative Easing coming to an end. But what has happened is that volatility has stayed very low and volume has dried up. With this combination it is very difficult to be profitable with intraday trading.

With the FOMC meeting next week there will be few, if any, intraday trades the rest of the month. I will use this time to make adjustments going forward. Most likely there will be much less intraday trading activity (systems will be more conservative) when volatility (measured by VIX) is low.

Portfolios Sold Out

All Index Trader portfolios and Index Swing portfolios are now sold out.

Systems still open for lease:

FedSwing ES

FedSwing TF

FedSwing YM

MeanSwing II ES

MeanSwing II TF