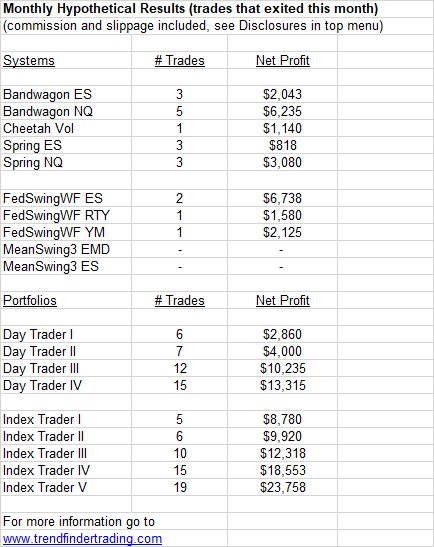

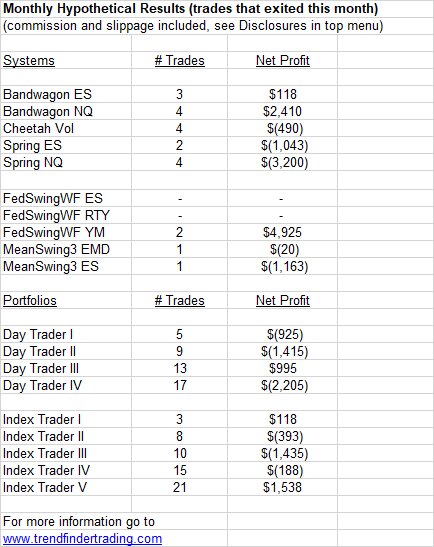

Monthly Results – September 2023

Bandwagon had a profitable month, and the other systems just had one trade each. Every portfolio ended positive for the month.

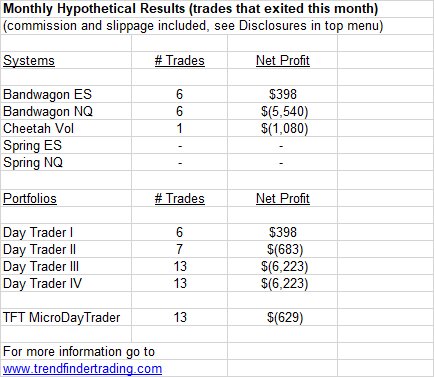

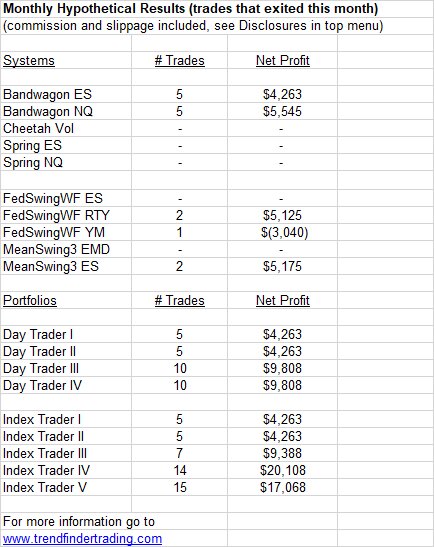

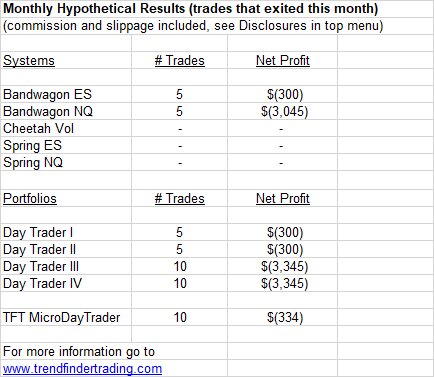

Monthly Results – August 2023

Not much to report. Only Bandwagon had any trades. Need volatility to return for these systems to be active again.

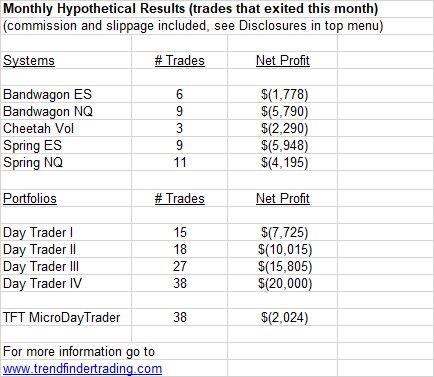

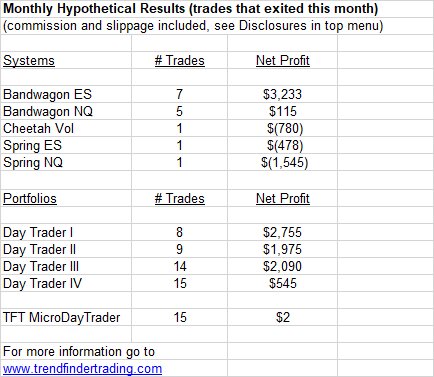

Monthly Results – July 2023

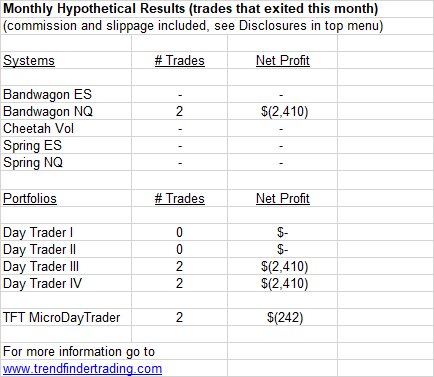

There were no trades this month. This is due to low volatility – the intraday systems only trade during periods of high volatility.