Shutting down

After 14 years of providing trading systems for the emini futures markets, I am officially shutting down Trendfinder Trading Systems LLC. After having great success from 2010-2016 with Trendfinder and Camkay Capital Management (Commodity Trading Advisor closed 2021), trading performance degraded, and I went back to structural engineering full time while maintaining Trendfinder. Maintaining Trendfinder is now ending also. I have found I don’t have the time needed to provide trading systems to the public.

I wish you the best and good fortune with your trading and happiness in life!

Micro futures strategy released

Due to demand, I have created a portfolio for the stock index micro futures. This portfolio can be traded with as little as $9000. It is called TFT MicroDayTrader, and it is composed of micro versions of the daytrading strategies Bandwagon, Cheetah, and Spring. Follow this link for more info: http://trendfindertrading.com/microdaytrader.html

Due to a lack of demand, the swing trading systems are no longer being tracked.

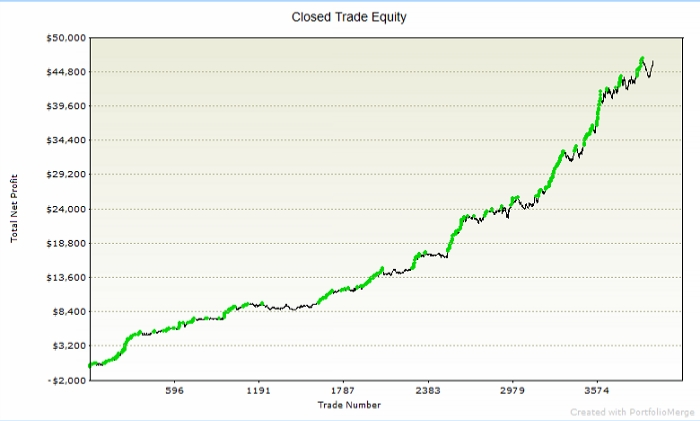

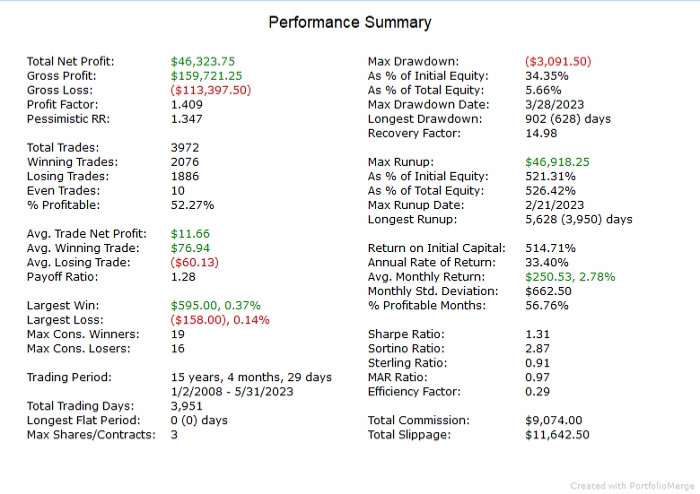

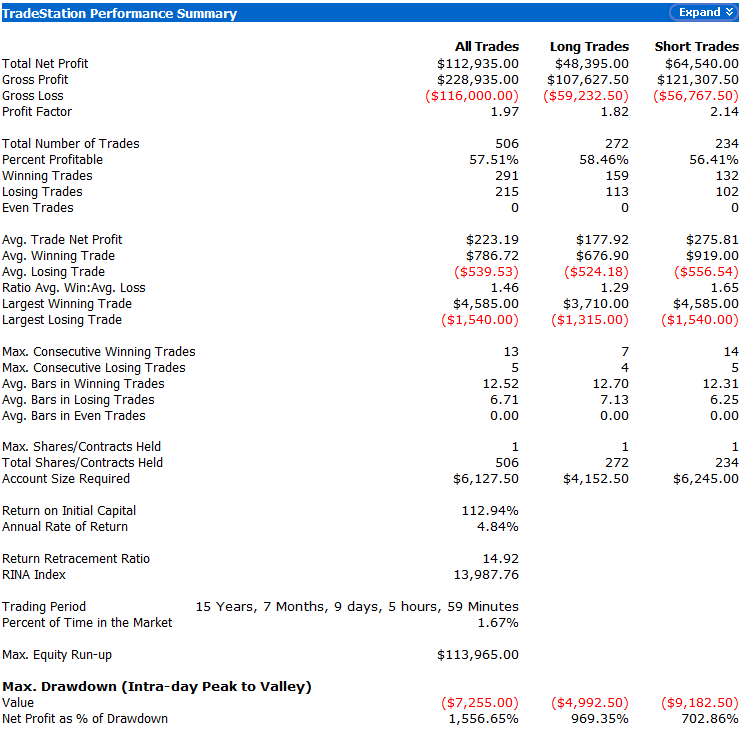

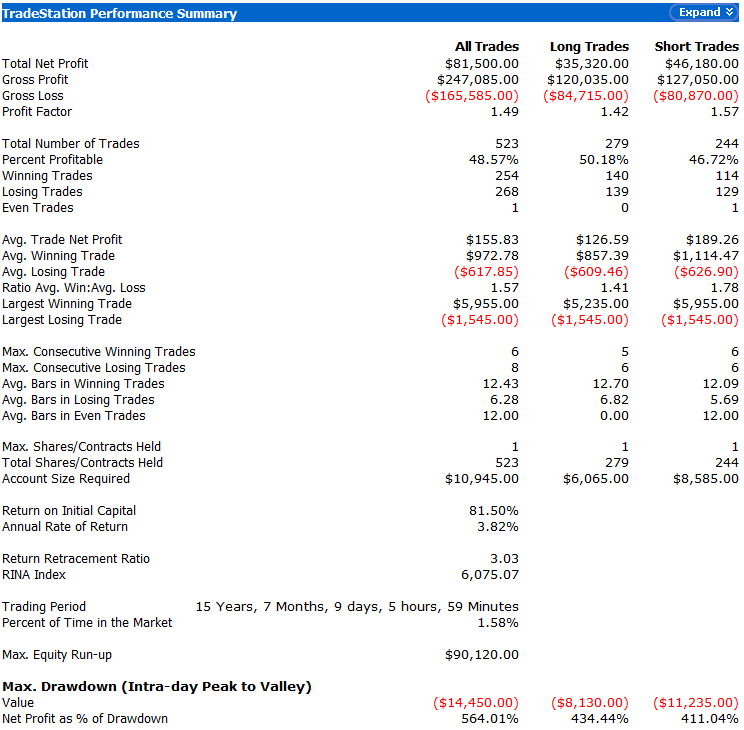

Below is performance information for TFT MicroDayTrader:

Update for Spring

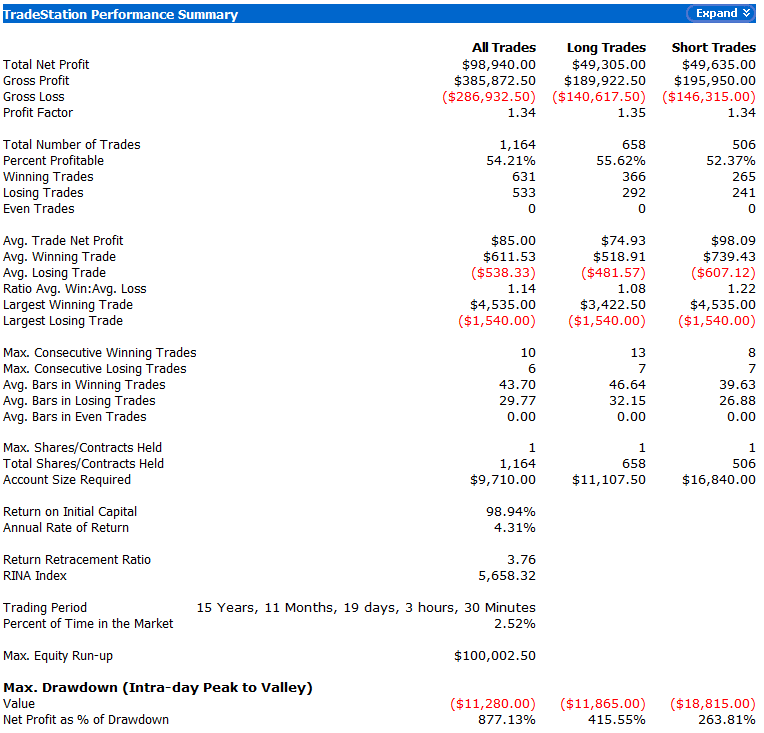

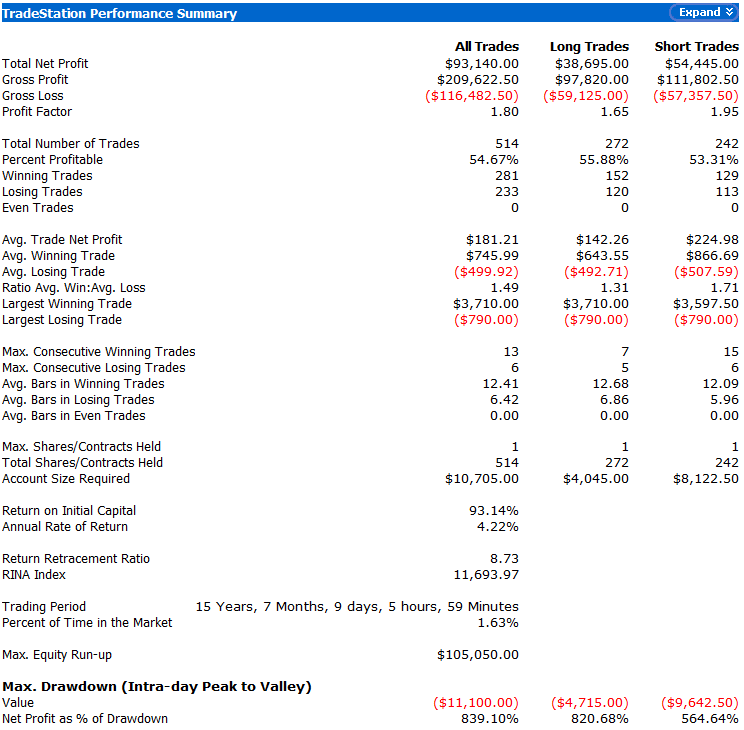

Similar to the Bandwagon update, I just applied a walk-forward update for Spring. I updated the stop to have a max amount of $1500 (instead of max $750). Also, I added a filter to not trade on FOMC minutes release days. This increase in stop amount makes a pretty dramatic difference for the NQ (net profit doubled). Below is a comparison. The larger max stop loss will hopefully handle volatile periods better going forward.

Original Spring ES:

Updated Spring ES:

Original Spring NQ:

Updated Spring NQ:

Update for Bandwagon

I just applied a walk-forward update for Bandwagon. I updated the stop to be more dynamic with a max amount of $1500 (instead of max $750). Also, I revised the filter for short trades around FOMC meetings and minutes release days. This increase in stop amount makes a pretty dramatic difference, especially for this year. Below is a comparison. The more dynamic and larger stop loss will hopefully adjust to volatile periods better going forward.

Original Bandwagon ES:

Updated Bandwagon ES:

Original Bandwagon NQ:

Updated Bandwagon NQ:

Walk-forward Update for Cheetah Vol

With the increase in price and intraday volatility of the Russell 2000 since Cheetah was first created, it is a good time to make a walk-forward update for the size of the stops used. Going forward a volatility based stop with a maximum of $750/contract will be used (currently stop is $375/contract). Since this will double the max loss per trade, only one trade per day will be allowed. This way the max loss per day will still be $1500 (plus slippage and commission).

SimpleSwing being discontinued

SimpleSwing2 has exceeded acceptable drawdown and is not performing as expected. It is being discontinued, and the swing systems used in the Index Trader portfolios are being modified to replace SimpleSwing2.

Bandwagon NQ and Spring NQ released

I am officially releasing Bandwagon NQ and Spring NQ. They use the exact same strategy code as Bandwagon ES and Spring ES. There is no alteration or optimization for use on NQ. Out of curiosity, I ran Bandwagon and Spring on NQ to see how it has been performing since the strategies were first created. When I saw the results, I was surprised by how well they had performed, especially in the past year or so.

Bandwagon NQ and Spring NQ replace Lion II Vol and Tiger Vol in the Day Trader and Index Trader portfolios. Lion II and Tiger have been around since 2009 and have reached retirement age. The website has been updated for Bandwagon NQ and Spring NQ, and starting today results on the blog will reflect the new systems and updated portfolio compositions.

Day Trading and a new Program for CTA

Since swing trading the last few years has not been good (it’s been pretty horrible), I have shifted my focus to only intraday trading. I also really like the risk control day trading (exit before end of day, no trades held overnight) provides compared to swing trading (where trades last an average of one week and are vulnerable to overnight gaps). I recommend the Day Trader portfolios (especially Day Trader I), and I may even stop offering the swing systems and Index Trader portfolios.

In addition to Trendfinder Trading Systems, I have a separate company called Camkay Capital Management, which is an NFA registered Commodity Trading Advisor (CTA). To keep the companies completely separate (compliance reasons) I have never mentioned that company here. However, I think that is a disservice to not let you know about it. So, for this one time, I will provide some information!

Camkay launched a new program in September called Crisis Alpha Intraday. Here is the NFA approved program description: Crisis Alpha Intraday attempts to take advantage of excessive stock market intraday movement during volatile markets. Low volatility periods are avoided, and there can be months with no trades. Since trades are only taken during environments when the stock market has typically declined, this program can provide hedging abilities for those that are invested in equity markets. Trades are generated on the emini S&P 500 futures with proprietary algorithms, and all positions are closed before the end of the day.

To find out more, please go to https://www.camkaycapital.com/. For information about the program, go to the “Strategy” page. Go to the “Program Information” page for performance and newsletters.

Day Trading Portfolios available

With the dynamics of the stock market over the past few years, trading with swing systems (trades that last around 1 week) has been precarious. Yes, there have been some winning trades, but there have been many times were a Trump tweet caused trades that were in good shape to be stopped out.

On the other hand, this increase in volatility is great for day trading systems! I’ve put together four portfolios that combine only day trading systems. These portfolios provide more risk control since they do not hold trades overnight. I think these portfolios might be a great choice given the current political environment. Performance information can be found here: http://trendfindertrading.com/portfolios.html

When to start a system – now?

I received a great question from a subscriber that I want to share with you. Below is the client’s question and my answer.

The question:

I have been wondering if it might be a good idea to buy another contract of ITV. The first half of 2019 has been tough for that system. However, it’s overall track record is quite good. Now may be the low point for the system as it goes on to return to it’s normal performance. Every system seems to have occasional losing streaks. The only reason it would not return to normal performance is if something in the markets it trades has fundamentally changed. This is something that you look at all the time and I don’t recall you mentioning anything along those lines.

I would be interested in your opinion. If you don’t want to give one, I understand. I am 70 years old and have been slapped around and kicked around enough by life to know that the outcomes are always my responsibility and not someone else’s.

My answer:

First of all, I would say that adding now versus adding when the portfolio hits new equity highs is the better choice in my opinion. One big frustration in this business is that clients start after a good run and then quit when there is a bad period. This is a virtually guaranteed way to lose money over the long run. It can be very hard to do but starting when there have been losses is much better with one caveat, that the strategies are still viable. I think you understand all of that and ask exactly the correct question. Kudos to you! It’s very refreshing to hear the right question being asked.

For swing trading, since Trump became President, it does seem something changed in the market. It may just be a coincidence though because the FOMC also became more hawkish around that time too. Either way (or because of both), the level of mean reversion in the stock market changed. The typical pullbacks weren’t the same amount or duration as before. This observation is what led me to make the swing systems dynamically adjust. I think this alteration greatly improves their robustness. The one caveat is that when Trump tweets, all bets are off. For instance, May would likely have been a profitable month if he hadn’t increased tariffs out of the blue. On the flip side, the FOMC has turned more dovish, which likely increases the likelihood of mean reversion trading improving.

For day trading, Trump and the FOMC were beneficial since they increased volatility. With trade wars likely to persist, the global economy not exactly booming, and Trump being unpredictable, volatility will probably remain higher than it was in 2013-2017. If that is the case, then day trading should continue to be profitable. Also, I am especially happy that I’ve been able to replace older underperforming systems with new ones that also provide more diversification. Spring ES has so far proven itself in live trading, and Bandwagon ES looks very promising based on testing and my personal live trading before releasing it.

Looking back, there have been fundamental changes in the market (FOMC and Trump). These changes were detrimental to performance for the swing systems the past couple of years and beneficial to the performance of the day trading systems. One change going forward (FOMC becoming dovish) should benefit the swing systems. Trump is likely not changing, so volatility should help the day trading systems. Although there is no way to say this with certainty, my view is that the foreseeable future looks like a good fit for these trading systems.

Thanks,

Gary