Updated short exit for FedSwing

Due to the tendency of the stock market to move up slowly and down quickly, I’ve been testing an additional stop to use for short trades. The stop gets smaller as the trade progresses. This stops us out much quicker when the market slowly moves upward. I am now ready to incorporate this in FedSwing as a walk-forward update. Starting tomorrow, FedSwing will utilize this new stop.

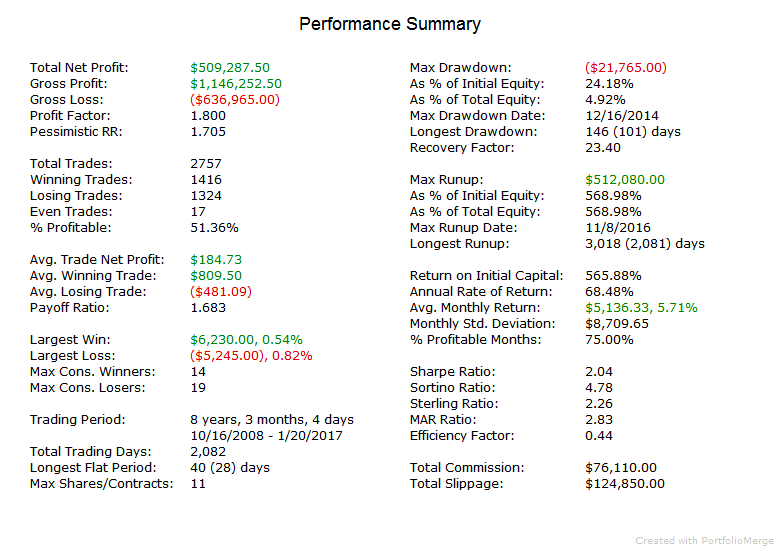

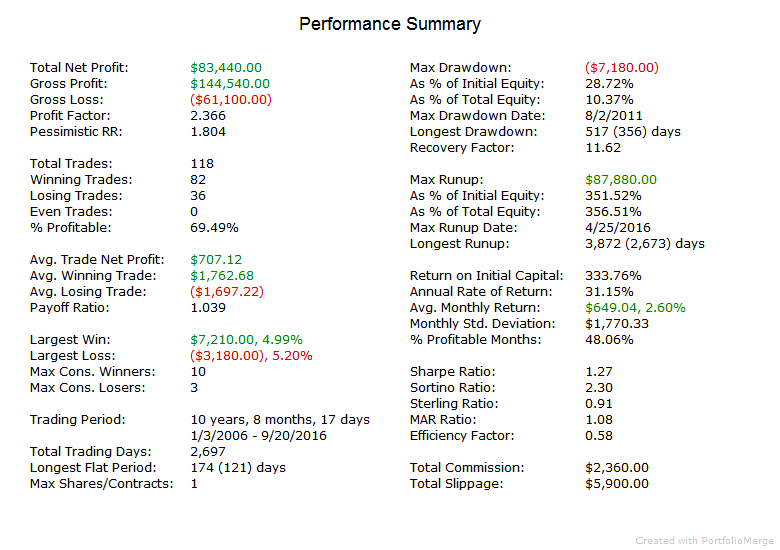

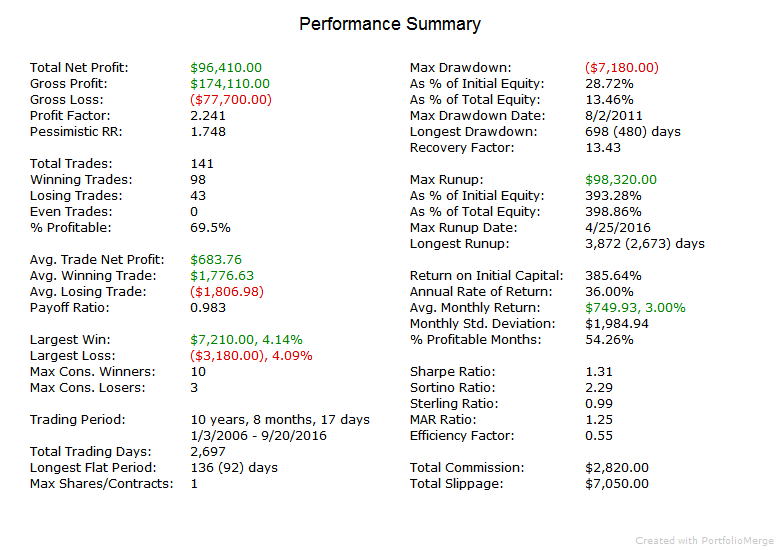

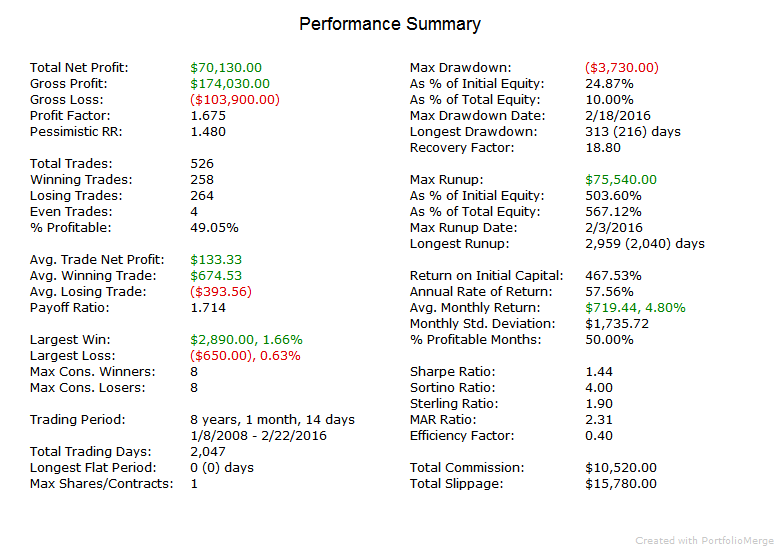

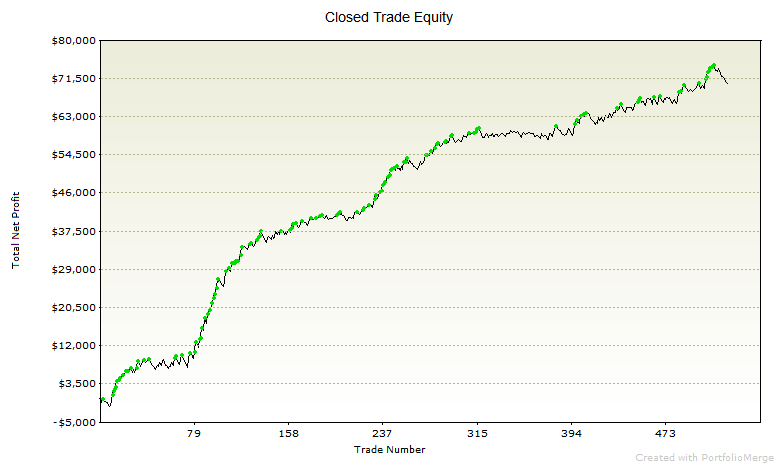

For comparison, below are performance summaries for FedSwing ES without and with the new stop. Full performance reports can be found in this zip file: FedSwing new stop

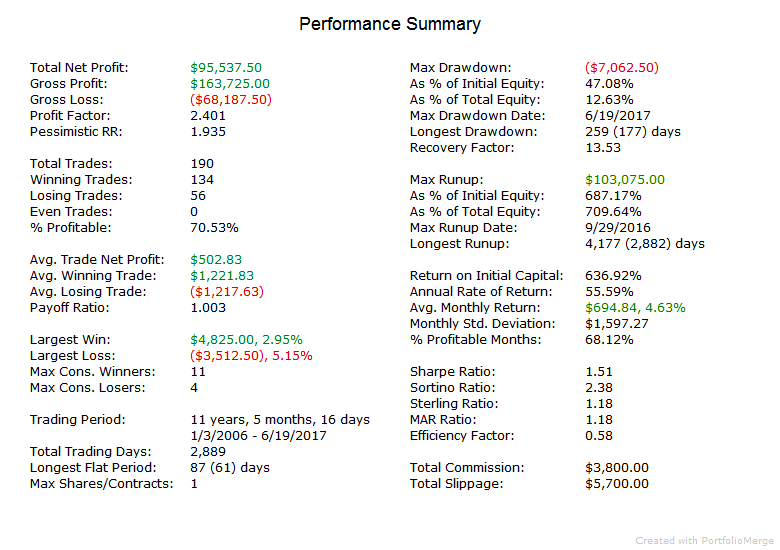

FedSwing ES – old stop:

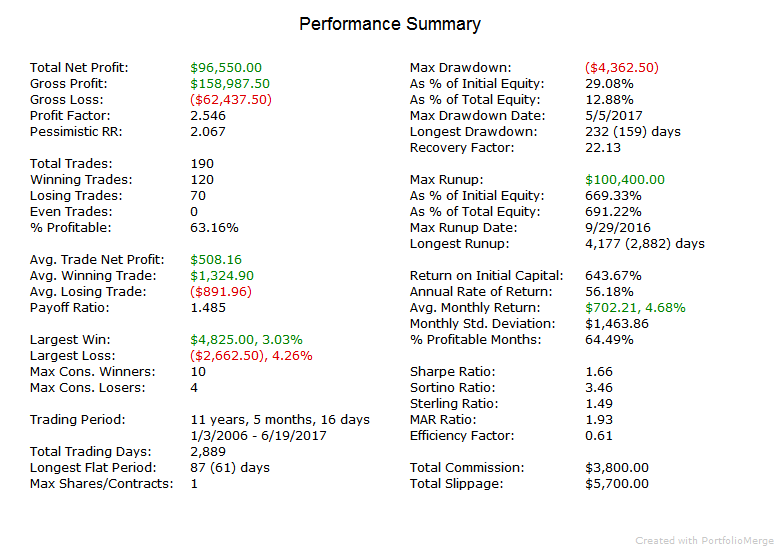

FedSwing ES – with new stop:

Better System Trader Podcast Interview

Andrew Swanscott was kind enough to include me in his Better System Trader podcasts (they are excellent!). Have a listen: http://bettersystemtrader.com/085-intraday-trading-strategies-gary-hart/

A note about low trading activity

Trendfinder’s trading systems have not been very active over the past few months. This is probably one of the quietest periods ever for them. The reason for this is that these systems are designed with risk control in mind (think low relative drawdowns), and therefore only enter trades when the odds are highly in their favor. For the intraday systems, this means not trading when markets have low volatility (we are at historic lows in volatility). For MeanSwing II, the market needs to have pullbacks to give high probability entries – we have not had any of those for several months. The newly released SentimentSwing is more consistent with trading activity, and FedSwing is more active than FedSwing II, so going forward there will be a little bit more trading activity in the Trendfinder Portfolios even if volatility stays low.

Although periods like this don’t give these systems a lot of opportunity to profit, these periods do typically occur during bull markets. Therefore, Trendfinder’s systems could be a very good allocation for your overall portfolio. With a portion of your equity invested in the stock market you benefit during bull markets, and with an allocation to Trendfinder’s systems you also benefit during choppy and bearish market conditions.

Updating the Portfolios – February 1 start date

For a couple of reasons, I have explored updating the systems used in the Portfolios. The first reason is that FedSwing II hasn’t had many trades because of current FOMC monetary policy (specifically with their open market account). Their actions have become more neutral to the market and have not provided much edge for FedSwing II to exploit. The second reason is that we now have another swing system (SentimentSwing) that can be used. SentimentSwing uses edges that are very different from the other systems and should be a great fit in the Portfolios.

The number crunching confirmed what I was hoping to see – the updated combinations of systems shows more consistency over time and even more profit (especially for the last two years). For the updated Portfolios, SentimentSwing has been added, the original FedSwing has been put back in, and FedSwing II has been removed. With the new combinations, no system trades more that 2 markets in any Portfolio – this helps risk management and diversification.

The following Portfolios are suggested combinations, and the ones that will be traded for clients that are subscribed to one of these Portfolios starting February 1. If there is any other combination you would like to trade and/or see performance results for (or you don’t want these updates), please let your broker know or email me (gary at trendfindertrading.com). The updated composition for each Portfolio is below (there will continue to be A and B versions as well):

Index Swing 2

MeanSwing II EMD, SentimentSwing ES

Index Swing 3

FedSwing ES, MeanSwing II EMD, SentimentSwing ES

Index Swing 4

FedSwing ES, MeanSwing II EMD, SentimentSwing ES, SentimentSwing NQ

Index Swing 5

FedSwing ES, MeanSwing II EMD, MeanSwing II ES, SentimentSwing ES, SentimentSwing NQ

Index Swing 6

FedSwing ES, FedSwing TF, MeanSwing II EMD, MeanSwing II ES, SentimentSwing ES, SentimentSwing NQ

Index Trader I

SentimentSwing ES

Lion II Vol

Index Trader II

MeanSwing II EMD, SentimentSwing ES

Leopard Vol, Lion II Vol

Index Trader III

FedSwing ES, MeanSwing II EMD, SentimentSwing ES

Leopard Vol, Lion II Vol, Tiger Vol

Index Trader IV

FedSwing ES, MeanSwing II EMD, SentimentSwing ES, SentimentSwing NQ

Leopard Vol, Lion II Vol, Lion III Vol, Tiger Vol

Index Trader V

FedSwing ES, MeanSwing II EMD, MeanSwing II ES, SentimentSwing ES, SentimentSwing NQ

Jaguar Vol, Leopard Vol, Lion II Vol, Lion III Vol, Tiger Vol

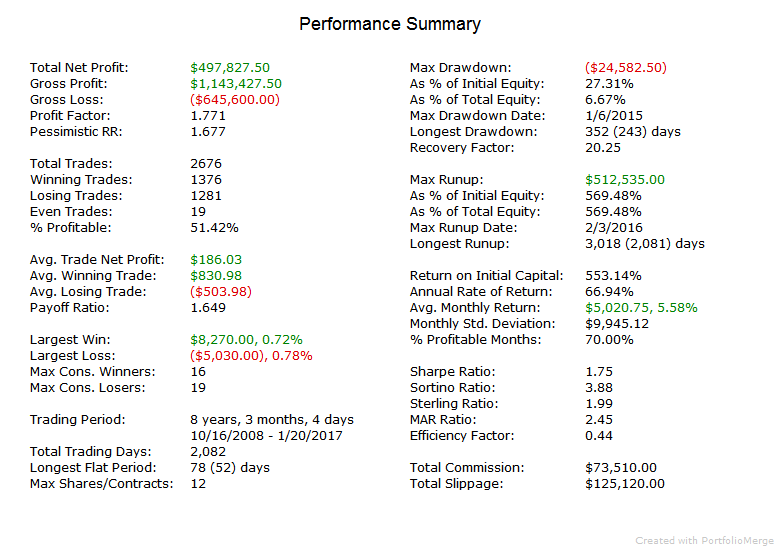

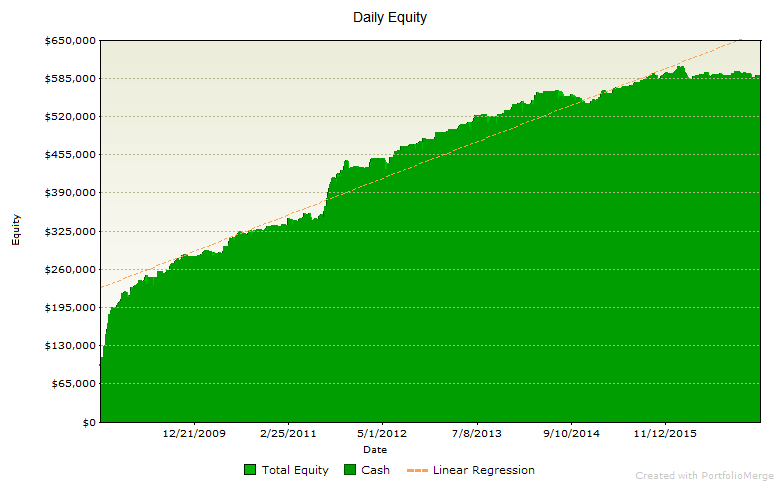

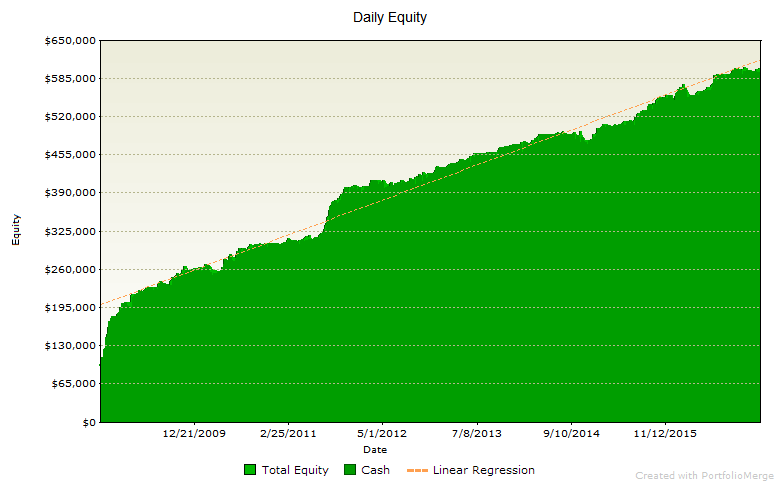

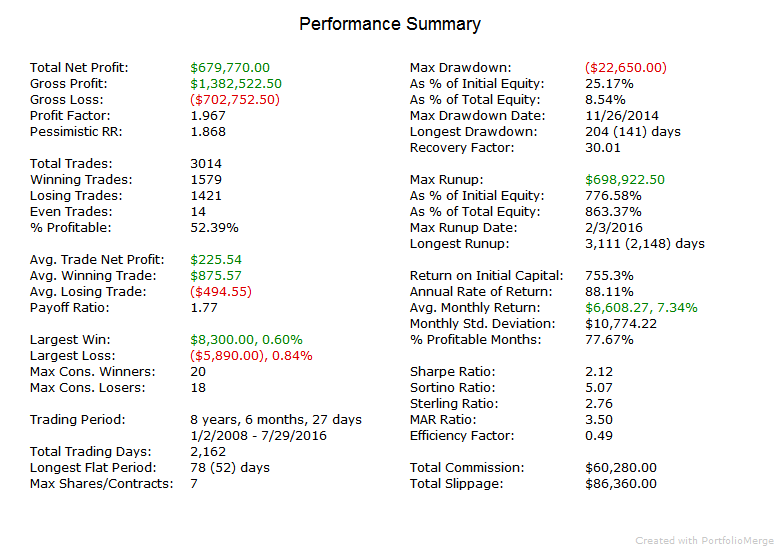

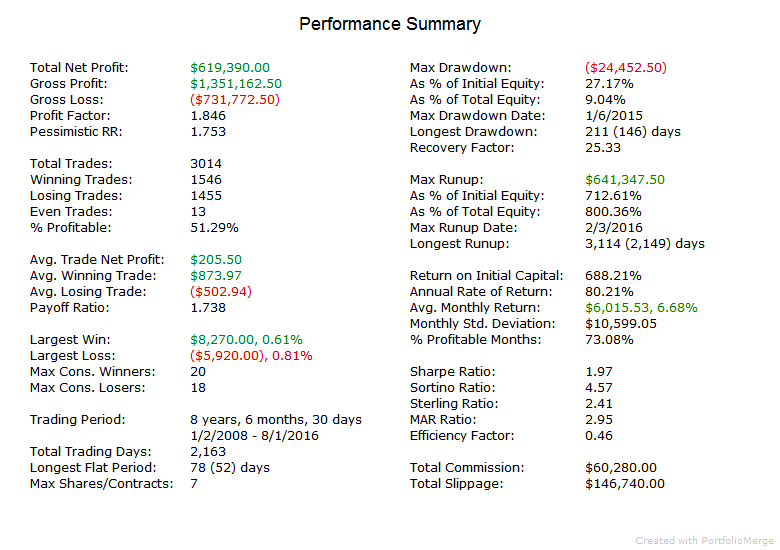

I am in the process of updating the website and will have it completed at the beginning of February. The earliest date for all symbols used is 4/8/2008. This symbol is used for SentimentSwing, and since SentimentSwing needs just over 6 months of data in TradeStation to run, the starting date for all Portfolio backtest results is 10/16/2008. For an apples-to-apples hypothetical backtest comparison of the existing and new Index Swing Portfolios, click Index Swing Portfolio comparisons. For the Index Trader Portfolios, click Index Trader Portfolio comparisons. As an example, comparisons for Index Trader V are below. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Current Index Trader V

FedSwing II EMD, FedSwing II ES, FedSwing II TF, MeanSwing II EMD, MeanSwing II ES

Jaguar Vol, Leopard Vol, Lion II Vol, Lion III Vol, Tiger Vol

New Index Trader V

FedSwing ES, MeanSwing II EMD, MeanSwing II ES, SentimentSwing ES, SentimentSwing NQ

Jaguar Vol, Leopard Vol, Lion II Vol, Lion III Vol, Tiger Vol

SentimentSwing – a completely new swing system

I am happy to announce the release of SentimentSwing which trades the stock index futures (ES, NQ, TF and YM). SentimentSwing utilizes multiple measures of stock market breadth and sentiment to determine when to enter and exit trades. It will enter when these measures are at an extreme or turning. It will exit when sentiment is no longer at an extreme or is turning.

Performance reports and graphs have been added to the website and can be found here: http://trendfindertrading.com/systems.html (if you don’t see SentimentSwing then hit F5 to refresh).

SentimentSwing will be added to the portfolios, and FedSwing II will likely be completely removed. My target date for this is February 1, but it will depend on when all brokers are set up and running.

Please take a look and let me know if you have any feedback and/or questions! gary at trendfindertrading.com

Russell 2000 price multiplier change

Starting today the ICE US exchange reduced the contract value from $100 per point to $50 per point. To maintain the original leverage that clients subscribed to, starting today all trades for the TF will be 2 contracts. The exchange reduced fees in half, and most brokers will likely reduce their commissions. However, the FCM’s may not reduce the per contract fee that they charge brokers. To account for this (and to be conservative), the total per trade round-turn commission and slippage cost for the TF used in this blog and website will be increased from $70 to $80 ($40 per contract).

Because of this change, my main focus right now is to determine whether to change the market used for the intraday systems and/or to start using partial entries/exits since we will be trading 2 contracts per trade. Another possibility is for trading multiple markets intraday. This change brings up many possibilities, and I anticipate working much longer hours this month!

There is nothing that clients need to do – just know that the number of contracts on the Russell 2000 will be twice as much as you’ve been used to.

FedSwing II walk-forward update

Now that we have had almost 2 years of post-QE Fed activity (US quantitative easing ended in October 2014), I looked at how FedSwing II has matched with the Fed’s actions and impact on markets. When I created FedSwing II in November 2014, I attempted to design the system to best fit the FOMC’s stated policies going forward. There were two methods of analyzing their actions I found to perform well, and I chose the more conservative version to use in the strategy. Now that we have almost 2 years of data to analyze (plus back to 2006), I find that version to be too conservative, and that the other method is a better fit. This is a fairly minor adjustment, but it has shown to provide much better trading results.

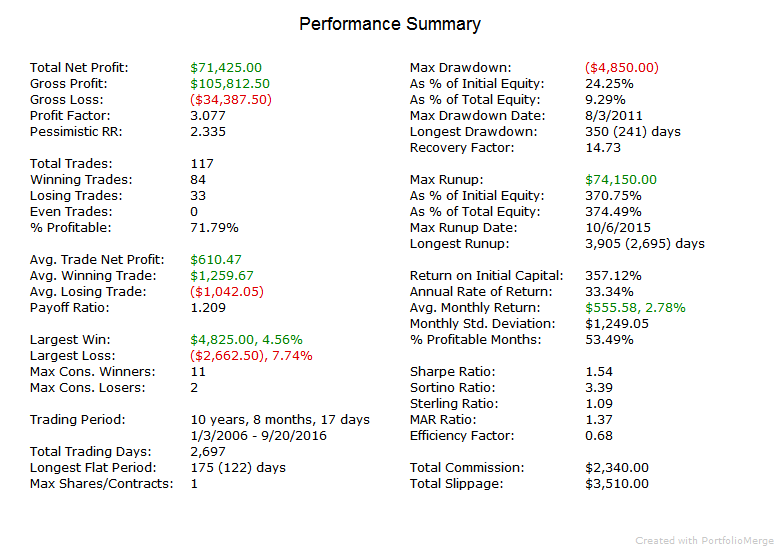

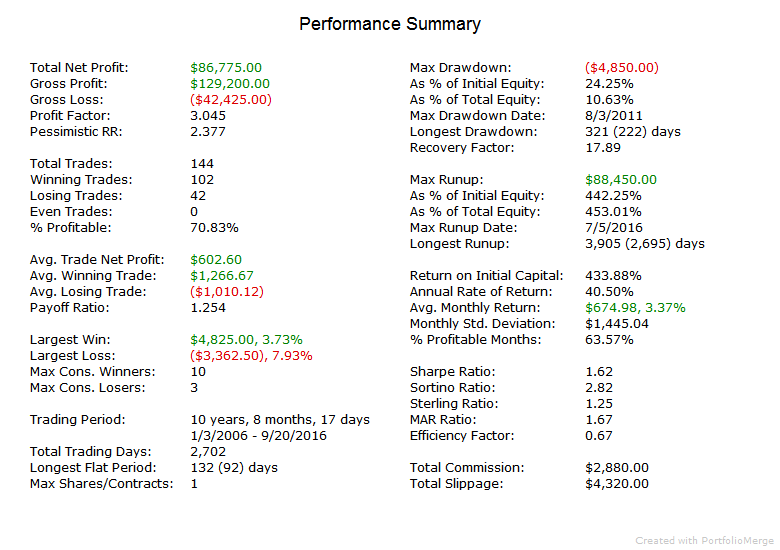

Starting 9/23/16, FedSwing II will use the updated method of analyzing the FOMC’s actions. This will be applied as a walk-forward update to the system. In the future, if the FOMC changes policies/guidance, then I may make future walk-forward updates at that time. To show comparative performance results of the method being used going forward, I am showing summaries below for ES and TF along with full performance reports for all markets.

Past performance is not necessarily indicative of future results.

FedSwing II ES old (version ending today):

FedSwing II ES new (version starting tomorrow):

FedSwing II TF old (version ending today):

FedSwing II TF new (version starting tomorrow):

Link to zip file containing full hypothetical performance reports for all markets: http://bit.ly/2cV5YPl

Increased costs for commission and slippage

A subscriber notified me last week that his actual returns were less than what I show on the website and blog. I researched this with his broker and one other, and I found that slippage had increased and, in some cases, commissions had increased. To better match actual client results, I am adjusting what I estimate for commission and slippage going forward. I am now using $50 roundturn for ES, $70 roundturn for EMD & TF, and $40 roundturn for NQ & YM (before 8/1/16, for intraday systems, $50 per roundtrip trade had been deducted to account for commission and slippage, and for swing systems, $20 roundtrip commission and 1 tick slippage each side had been deducted from each trade).

Based on account performance provided to me, the new commission and slippage estimates probably slightly understate the actual slippage for the original version of the portfolios, however they probably overstate the actual slippage for the A & B versions. To keep things manageable, I’m using the same estimates for all versions.

Starting now, the blog and “since release” results will be using these new values. I will update the website performance reports with the new values when I update results after this month ends. For a quick comparison of the effect, below is the performance summary for the Index Trader V Portfolio with the previous and updated estimate of commission and slippage. Past performance is not necessarily indicative of future returns.

Index Trader V Portfolio – Previous estimate for commission and slippage:

Index Trader V Portfolio – Updated estimate for commission and slippage:

New intraday system – Lion III Vol

Lion III Vol has been sent to brokers for trading starting tomorrow. It replaces Lion Vol in the Index Trader IV and V portfolios. Lion Vol had a severe drawdown starting at the end of August which far exceeded its previous maximum drawdown. Therefore Lion Vol is being retired, and Lion III Vol will be used going forward. The primary differences for Lion III Vol in comparison to Lion Vol: filtering for days to trade was greatly simplified, and a filter was added which attempts to detect choppy days.

Below is backtest performance for Lion III Vol. Past performance is not necessarily indicative of future results. Commission and slippage included. See Disclosures/Disclaimers for more info.

Hypothetical Performance 1/1/2008-current (based on a $15,000 account not compounded):

For the full performance report, please click here.

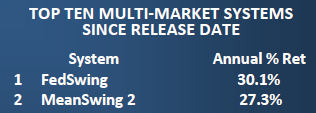

Update for Futures Truth rankings

I received the latest Futures Truth magazine today, and realized I haven’t posted an update here in a year. FedSwing and MeanSwing II continue to be at the top of the multi-market systems since release date.

Results above are through October 31, 2015. Futures Truth hypothetical percentage returns are based on “Min. Req. Cap.” which they calculate as 5 times Margin. Returns include $25 round turn for commission and slippage per trade. Please see Futures Truth magazine for more information.