Individual system subscriptions for EMD now Sold Out

In looking at real fills from multiple brokers today for MeanSwing II EMD (also A and B), it is apparent that actual slippage has exceeded a level I am comfortable with. These swing systems have a very large average profit per trade and can still be profitable at this level of slippage, however the trades are having too much impact on the market in my opinion.

Therefore, I am closing individual subscriptions to FedSwing EMD (also A) and MeanSwing II EMD (also A and B).

Individual swing system subscriptions for other markets (ES, TF, YM) are still open.

Portfolio subscriptions are still open for now. There are currently 28 lots left for the Index Trader ‘B’ Portfolios (combination of swing and intraday systems). And there are currently 6 lots left for the Index Swing ‘A’ Portfolios. There will not be any more alternative versions when these portfolios are sold out. When they are sold out, no more portfolio subscriptions will be available and no individual subscriptions for the TF. Individual swing system subscriptions for the ES and YM will be the only subscriptions available (FedSwing ES, FedSwing YM and MeanSwing II ES).

My current focus is creating new systems and portfolios that exclusively trade the ES (S&P 500). I do not rush systems out so it may be 2015 before anything new is released.

Thanks,

Gary

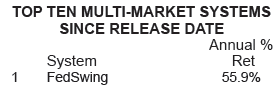

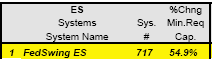

Futures Truth – FedSwing #1 and MeanSwing top 10

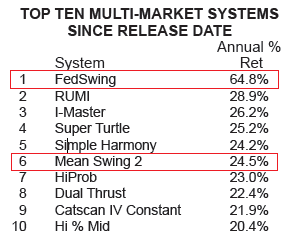

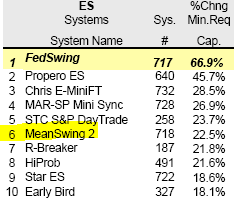

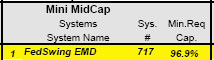

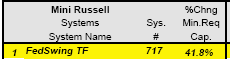

The latest issue of Futures Truth Magazine came out today. FedSwing is #1 for multi-market systems and for each individual market as well. MeanSwing II was in the top 10 for each of these categories as well.

Futures Truth hypothetical percentage returns are based on “Min. Req. Cap.” which they calculate as 5 times Margin. Returns include $25 round turn for commission and slippage per trade. Please see Futures Truth magazine for more information.

Index Trader “A” Portfolios Sold Out

The Index Trader “A” portfolios have reached capacity and are now closed to new subscriptions. All new Index Trader portfolio subscriptions will be placed on the “B” version. The “B” version will utilize charts of a slightly different length similar to the way the “A” portfolios are constructed (see this blog post for more information). One additional change is that stop losses for the intraday systems in the “B” version are slightly modified to reduce chances of coinciding with the original and “A” versions.

When the Index Trader “B” portfolio subscriptions reach capacity they will be closed to new subscriptions. Once this happens, all of the Index Trader portfolios will be sold out. There will not be a “C” version. The Index Trader portfolios will be closed to new subscriptions.

Futures Truth Interview & Systems Rankings

I was interviewed by Futures Truth, and it was published in their latest issue (4th Quarter 2013). Here is a link: Futures Truth Interview

In this Futures Truth issue, FedSwing was ranked #1 for “Multi-Market Systems Since Release Date”:

FedSwing was also ranked #1 for each stock index they track (for results since release date):

MeanSwing II was #9 for the ES, #5 for the EMD, and #12 for the TF in the same category.

Futures Truth hypothetical percentage returns are based on “Min. Req. Cap.” which they calculate as 5 times Margin. Returns include $25 round turn for commission and slippage per trade. Please see Futures Truth magazine for more information.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

THERE IS A SUBSTANTIAL RISK OF LOSS IN FUTURES TRADING. THE HIGH DEGREE OF LEVERAGE THAT IS FOUND IN FUTURES (BECAUSE OF SMALL MARGIN REQUIREMENTS) CAN WORK FOR YOU AS WELL AS AGAINST YOU, I.E. YOU CAN HAVE LARGE LOSSES AS WELL AS LARGE GAINS.

EMD swing systems sold out – alternate versions being released

Subscriptions for FedSwing EMD and MeanSwing II EMD have reached capacity. Alternate versions are being released. All new subscriptions will be placed on the new versions (FedSwing EMD-A and MeanSwing II EMD-B). Each of these systems use the exact same code as the original but are used on charts that are 1 minute shorter than the original so that orders do not coincide and increase slippage. If you are wondering about “MeanSwing II EMD-A”, its capacity is already allotted due to its inclusion in all of the Index Swing and Index Trader “A” portfolios so I am releasing the “B” version for individual subscriptions. For more information on alternate systems/portfolios please read this blog post.

Similarly, the original version of the swing only portfolios (Index Swing) are sold out as well. I am releasing the “A” versions of them now, and all new subscriptions will be placed on them.

Additional Portfolios Released

Subscriptions to the Index Trader Portfolios have reached the point where slippage may start becoming larger than what is used in back-test reports and real-time blog post results if additional subscribers are added. To remedy this situation I have created alternate portfolios that use charts slightly different than the original portfolios. The strategy code for each system is the exact same for the alternate and original portfolios. The only difference is the bar interval used.

For example, Lion II Vol runs on 3 minute bars, which is 180 seconds. Lion II Vol for the “A” portfolios uses 179 seconds bars. The swing systems for EMD and TF used in the Index Trader portfolios are modified in a similar manner (ES has much more capacity and doesn’t need an alternate yet). For example, FedSwing EMD bars are essentially daily bars that match stock market hours (9:30-4:00 ET). FedSwing EMD for the “A” portfolios uses a bar that runs from 9:30-3:59 ET. This way the systems for both are basically the exact same but the orders for the “A” portfolio will not occur at the same time as the original portfolio.

Short term results will vary between the two portfolios, but over the long term (1 year or more) the performance should be similar. There will be days where a system triggers in one portfolio but not the other, and even a situation like what happened yesterday where Jaguar Vol had a losing short trade in the original portfolio but had a winning long trade in the “A” portfolio. There is no way to know which portfolio version will perform better over the next year or 5 years. If you are trading more than one lot of a portfolio, you could distribute lots to both portfolios and increase diversification.

I will be updating the website over the next week to show the base Index Trader Portfolios as sold out. Current subscribers to the Index Trader portfolios will continue to trade the original portfolios/systems they have been trading. New portfolio subscribers will be using the Index Trader “A” portfolios. When capacity is reached for the “A” portfolios I will release “B” portfolios. The individual swing systems are not sold out yet – as each reaches capacity I will release an alternate version.

For the blog, to keep the results posts from being too large and confusing, I will no longer be posting results for each individual intraday system. Since there are many that only subscribe to individual swing systems, I will continue to post results for them. The daily/weekly/monthly blog posts will now show results for each swing system and each Index Trader portfolio (both original and “A”). To keep record-keeping clean (and since there are several open swing trades) I will start this new format at the beginning of September.

If you have any questions please feel free to contact me. Contact info is here: http://trendfindertrading.com/contact.html

Receive Tweets via text messaging

Did you know you can have Trendfinder’s tweets texted to you? Text the following to 40404: follow trendfinder_

This way you can stay up to date with trades within a few minutes of them happening.

Twitter will also send you some other tweets. To turn them off, text to 40404: discover off

FedSwing top ranked in Futures Truth

I hadn’t looked at the Futures Truth rankings in a while so I purchased the latest issue (#1-2013) that came out a few weeks ago. I was happy to see that FedSwing had the top ranking for the Russell 2000 (TF) and S&P MidCap 400 (EMD). This is based on performance since release date. FedSwing was only out for a year and beat all other systems for total return.

System Updates

Due to numerous requests, FedSwing for the Dow emini (YM) is now being offered! This is a good system choice for those that want to trade FedSwing but have an account size less than $25,000. The minimum recommended account size for FedSwing YM is $15,000.

I am retiring Cougar Vol and Lion. It is sad to see the original Lion go (it’s been around almost 4 years now), but the newer versions (Lion Vol and Lion II Vol) provide much improved performance. I’ve updated the systems used in the portfolios to accommodate these changes.

I am also retiring the Wildcat Portfolios. The Index Trader Portfolios provide a MUCH better product, and since they are the ones I always recommend, there is no need to maintain the Wildcat Portfolios.

Twitter updates

You can view the results of every intraday trade on my Twitter feed: twitter.com/Trendfinder_

Tweets are set up to automatically post both when a system has entered and after it has closed with the net result (posts are sent with a few minutes delay). I hope you find that valuable.

I will be out of town 8/1-3. I will post daily results here in the blog when I can. Please view the Twitter feed to see immediate results.