Bandwagon ES – new day trading system

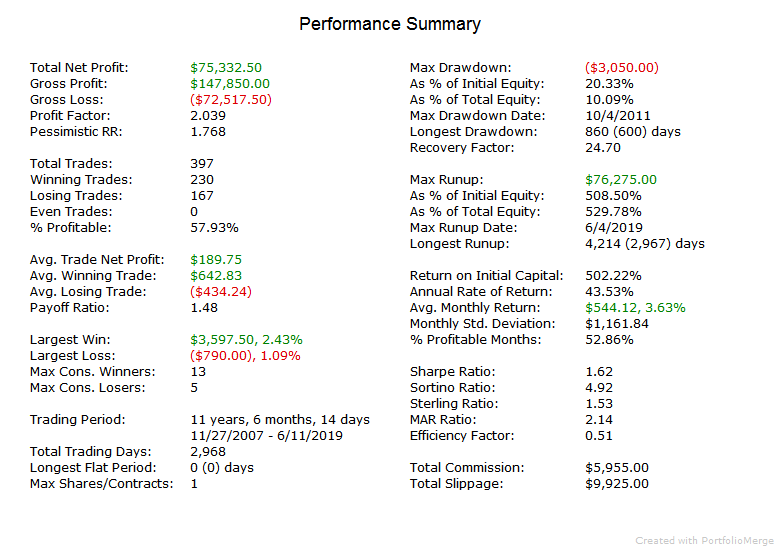

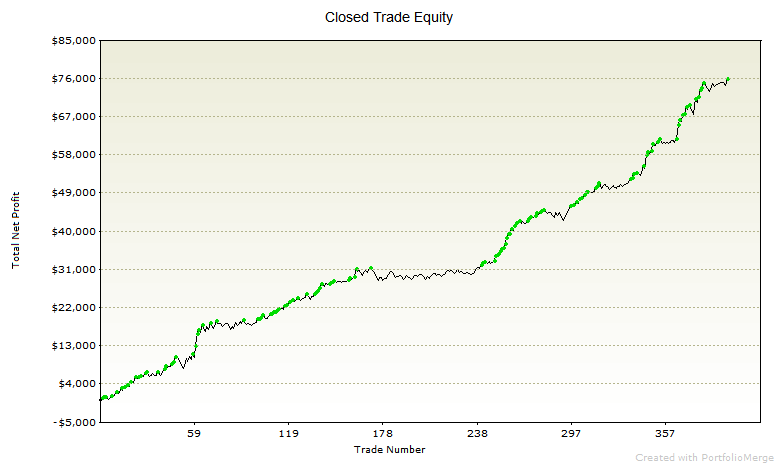

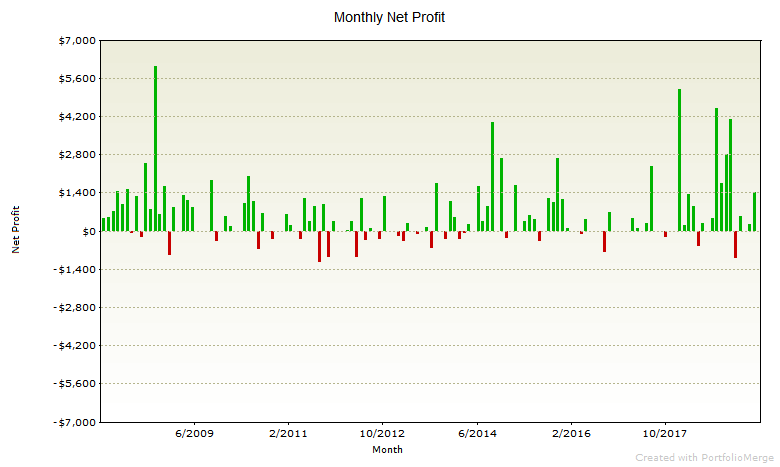

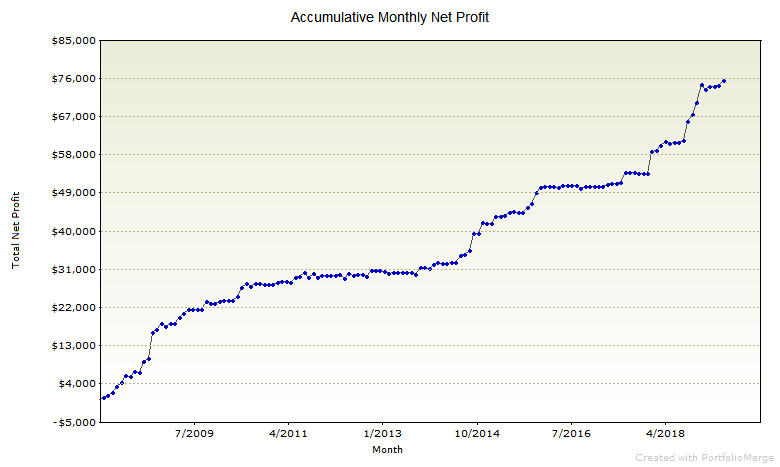

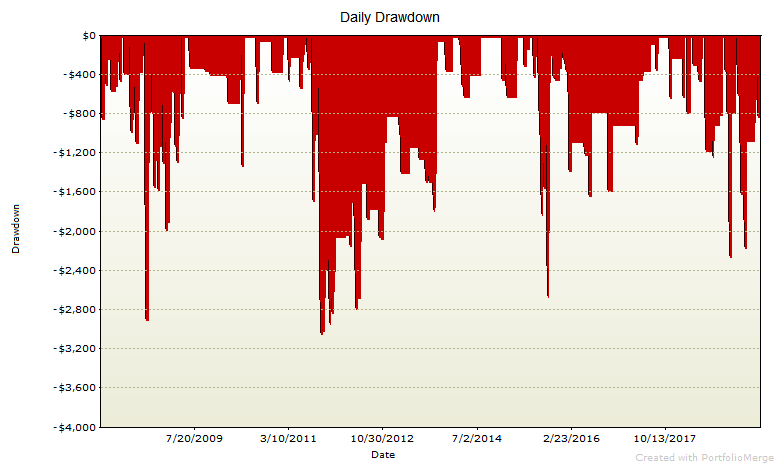

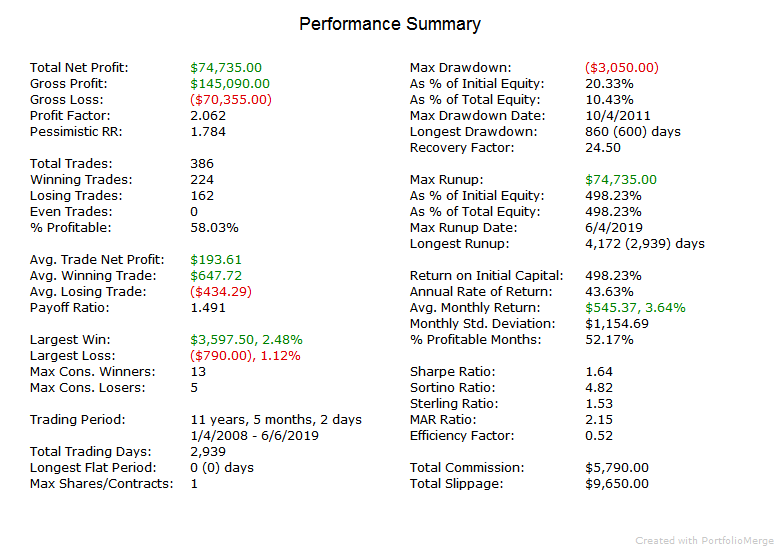

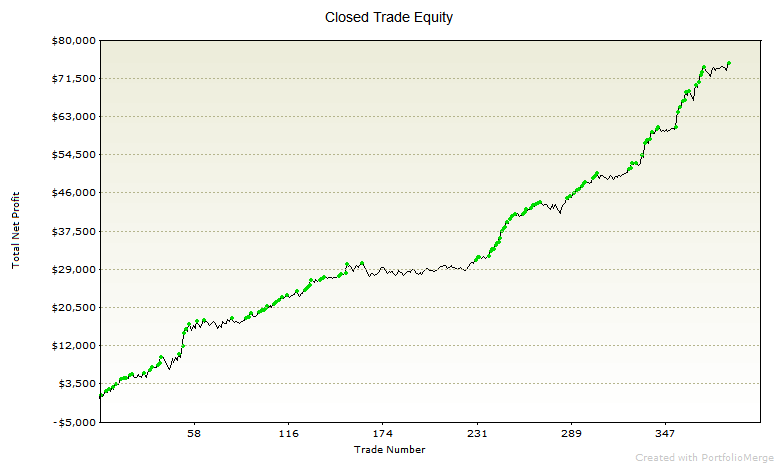

I’m excited to let you know that Bandwagon ES has been released. During periods where large intraday moves are more likely, it will look to “jump on the bandwagon” when the market is heading up or down convincingly. For determining what days to trade (where large moves are more likely), it uses different filters than all of the other intraday systems, providing better diversification. Most trades are entered within the first hour after the stock market opens, and it looks to hold all day. There is a stop loss, a trailing type of stop and end of day exit. It is a very straightforward system, and it performed exceptionally well on out of sample data. It was profitable every year including 2019 YTD.

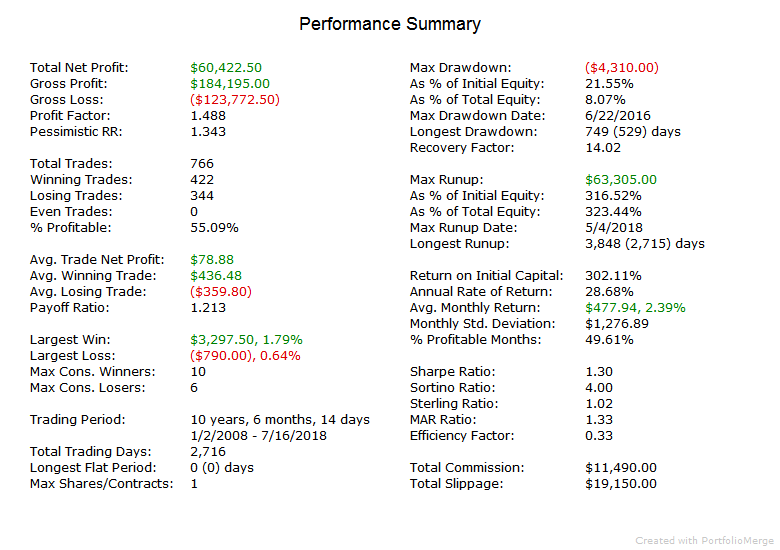

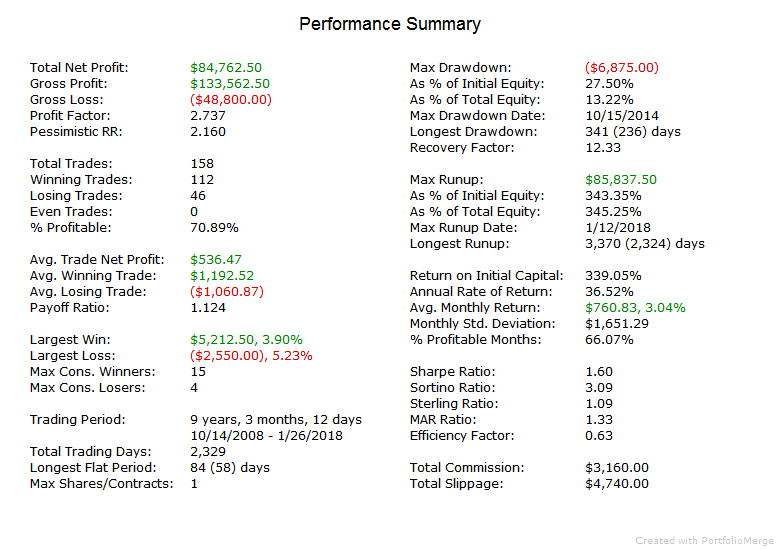

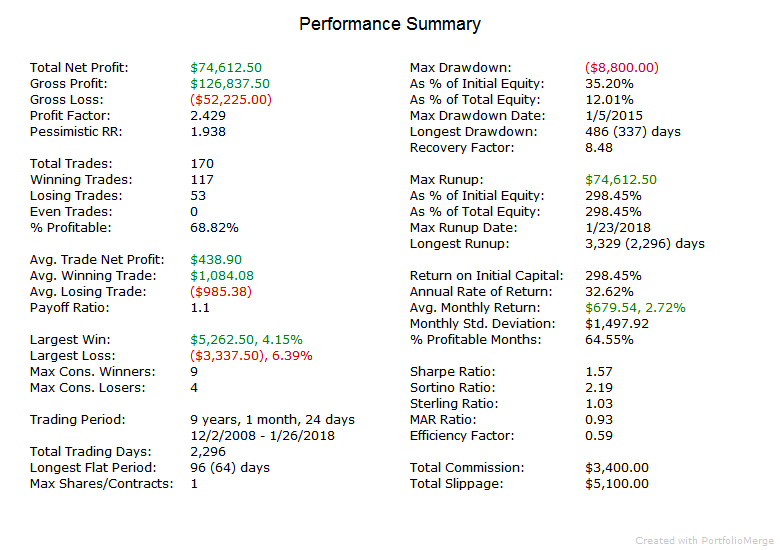

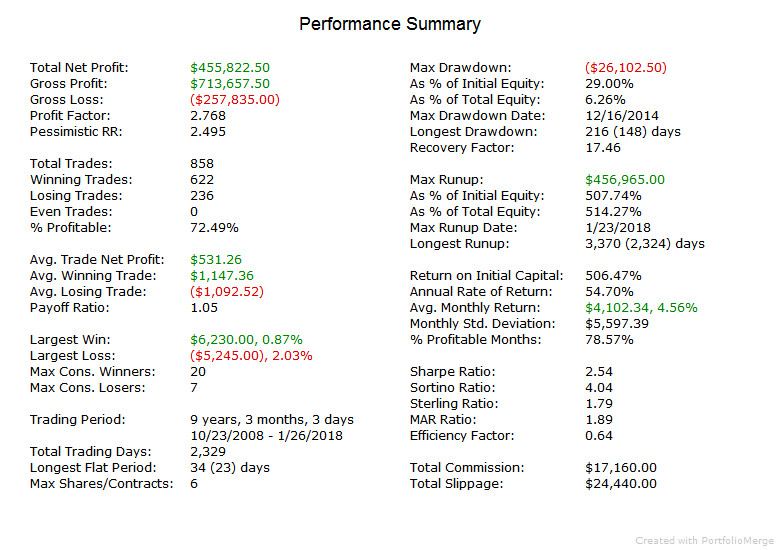

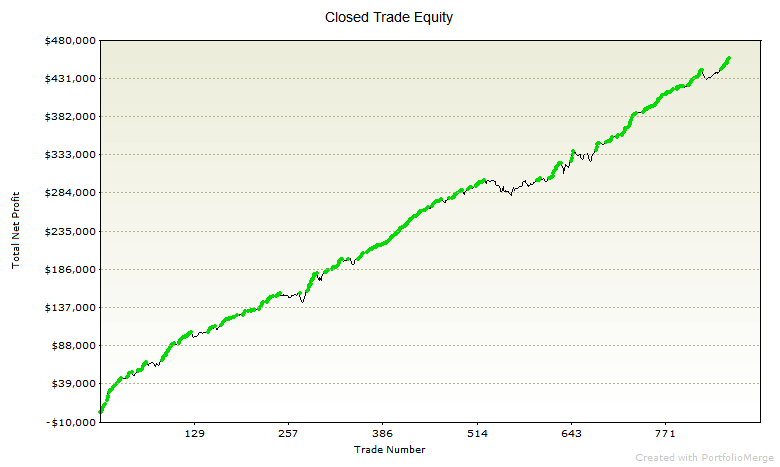

The website has been updated ( http://trendfindertrading.com/bandwagonES.html). Bandwagon ES is included in all of the Index Trader Portfolios. It replaces Spring ES in Index Trader I and II, and it replaces Leopard Vol in Index Trader III, IV and V. All available hypothetical performance info through yesterday is below. Past performance is not necessarily indicative of future performance. Full report: Bandwagon ES

New day trading system coming

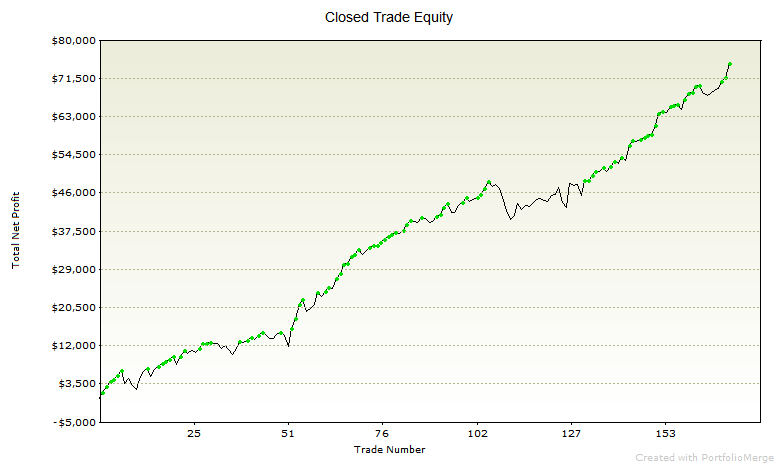

I’m excited to let you know that I will be releasing a new day trading system next week. It is called Bandwagon ES. During periods where large intraday moves are more likely, it will look to “jump on the bandwagon” when the market is heading up or down convincingly. Most trades are entered within the first hour after the stock market opens, and it looks to hold all day. There is a stop loss, a trailing type of stop and end of day exit. It is a very straightforward system, and it performed exceptionally well on out of sample data. It has been profitable every year including 2019 YTD.

I will update the website next week, and it will be included in the Index Trader Portfolios (likely replacing Leopard Vol). For now, the summary and equity curve are below. Past performance is not necessarily indicative of future performance.

A comment about Spring ES

Spring ES and the other daytrading systems haven’t had a trade since January. I’ve had a few ask about this, so I am posting this for everyone.

Spring ES and the other daytrade systems avoid periods where volatility is low. These periods (like now) are poor conditions for day trading. The potential for profit is low because the market moves are small and choppy, and therefore the reward/risk ratio is very poor. Trading during low volatility periods is only beneficial for the broker (and not really even then, because people will stop trading the system because of the losses). October-December 2018 had very high volatility, so Spring ES had trades almost every day. When volatility picks up again, Spring ES will be more active again. When the odds are not in your favor, it’s better to not trade at all than trade just to trade. One edge we have as traders is that we get to pick when to trade. A good analogy is that it’s better to only swing at strikes than try to hit every pitch (only swing at the fat ones).

Patience is definitely a virtue in trading. We can’t control the markets but we can control when we trade.

New swing systems and updated portfolios

The website has been updated for the new swing systems and portfolio combinations. FedSwing is resurrected with a walk-forward update, MeanSwing and SimpleSwing became dynamic/adaptive, and SentSwing is retired. I will be sending the code and charts to brokers this weekend.

For FedSwingWF, I changed one parameter and used a walk-forward method for when the FOMC changed methods to fulfill their intentions. For example, until 2014 they utilized open market operations (POMO), then they stopped POMO and started utilizing a balance sheet reduction (SOMA). Going forward I will adjust the measures used by the strategy when the FOMC changes their methods.

MeanSwing3 adjusts parameters based on volatility. The overall profit is lower now but the drawdown is much lower. Also, the performance is much more consistent over time. With dynamic parameters, the entry timing was improved so much that I was able to reduce the maximum stop loss from $5000 to $3000. With the reduced number of trades, better timing, and reduced stop loss, the probability of a very large drawdown in the future is reduced.

SimpleSwing2 also adjusts parameters based on volatility. I also added a trailing stop and adjusted the filter for shorts. Similar to MeanSwing3, performance is much more consistent over time.

Take a look at the new systems at http://trendfindertrading.com/systems.html and the portfolios at http://trendfindertrading.com/portfolios.html. FYI, you may have to hit shift+F5 or ctrl+F5 to refresh the pages.

Discontinuing Index Swing Portfolios

The stock market character has changed over the past few years (especially this year), and mean-reversion type of swing systems are not performing well. They are now best used when combined with daytrading systems. Because of this, I am discontinuing the Index Swing portfolios.

Updated Portfolios

With the new addition of two daytrading strategies, I took the opportunity to completely reorganize the composition of the portfolios. I used a quantified combination of performance and correlation to determine the best combinations. You can see the performance of these portfolios on the website here. Going forward these are the compositions that will be used:

Index Trader I: MeanSwing II EMD, Spring ES

Index Trader II: MeanSwing II EMD, SentSwing II RTY, Leopard Vol, Spring ES

Index Trader III: MeanSwing II EMD, SentSwing II RTY, SimpleSwing ES, Cheetah Vol, Leopard Vol, Spring ES

Index Trader IV: MeanSwing II EMD, SentSwing II RTY, SentSwing II YM, SimpleSwing ES, Cheetah Vol, Leopard Vol, Spring ES, Tiger Vol

Index Trader V: MeanSwing II EMD, MeanSwing II ES, SentSwing II RTY, SentSwing II YM, SimpleSwing ES, Cheetah Vol, Leopard Vol, Lion II Vol, Spring ES, Tiger Vol

Index Swing 2: MeanSwing II EMD, SentSwing II RTY

Index Swing 3: MeanSwing II EMD, SentSwing II RTY, SimpleSwing ES

Index Swing 4: MeanSwing II EMD, SentSwing II RTY, SentSwing II YM, SimpleSwing ES

Index Swing 5: MeanSwing II EMD, MeanSwing II ES, SentSwing II RTY, SentSwing II YM, SimpleSwing ES

Index Swing 6: MeanSwing II EMD, MeanSwing II ES, SentSwing II RTY, SentSwing II YM, SimpleSwing ES, SimpleSwing NQ

Along with updating the portfolios, I also retired SentSwing II NQ, Jaguar Vol and Lion III Vol. I have several new daytrading systems in incubation. When those pass final testing, I will release them, update existing portfolios, and create portfolios of only daytrading systems.

New Intraday System – Cheetah Vol

I am releasing Cheetah Vol today. It is an intraday system that has some similarities to the other Vol systems. The biggest difference is that it starts taking trades 45 minutes after the open, whereas the other Vol systems start around 2 hours after the open. Performance summary below, and full report is here.

Spring ES – a new day trading system

I am always testing ideas for new trading systems. After the sharp drop in February this year, I put my focus on day trading systems. Although not guaranteed, it appears that the extremely low volatility we’ve had in recent years is unlikely to repeat anytime soon. The markets will probably have more typical volatility, and therefore will be more accommodating to intraday systems. I will be releasing more intraday systems over the next few months and revising the portfolios.

Spring ES is a day trading system for the emini S&P 500 futures. The strategy identifies when the market is likely to spring out. It enters with a market order and uses an initial stop, a trailing stop or end of day to exit. It was developed with walk forward analysis which reduces the chances of over fitting and allows the system to adapt to future market conditions.

It performs well in volatile markets, including February and March this year. Hypothetical performance is shown below and at the webpage: http://trendfindertrading.com/springES.html Past performance is not necessarily indicative of future results.

Hello SimpleSwing and SentSwing II, Goodbye FedSwing and SentimentSwing

Out with the old and in with the new! I am happy to announce that two new swing systems are being released – SentSwing II and SimpleSwing. FedSwing, FedSwing II and SentimentSwing are being retired.

SentSwing II is version 2.0 of SentimentSwing. The code is actually simpler now. It holds long trades longer and uses a much improved (and simpler) short entry filter. In a previous blog post, I said that 2 data streams were being added (they were to be used as a short filter). I have decided against doing this. It increased the chances of over fitting, and I found a better filter with data already being used. SentSwing II will replace SentimentSwing in the Portfolios.

SimpleSwing is a new swing system composed of two simple long strategies and one simple short strategy. It uses price, VIX and 52 week highs/lows for determining trades. I would like to say more about it, but really that’s it! The idea is to use very simple robust strategies that match the character of stock market indexes. SimpleSwing will replace FedSwing in the Portfolios.

FedSwing, FedSwing II and SentimentSwing have had very poor results for the past 12 months and are being retired. The short answer to why is that they were entering short trades during one of the most, if not the most, bullish periods ever. FedSwing was a wonderful system for many years, especially when the FOMC was active in the open market with Quantitative Easing and Operation Twist. Their current actions have not had the typical impact on the stock market, and therefore FedSwing has been out of sync. SentimentSwing was too aggressive with short trades, and it was exiting long trades too quickly. This is not a good fit for the stock market since it has an underlying bullish bias.

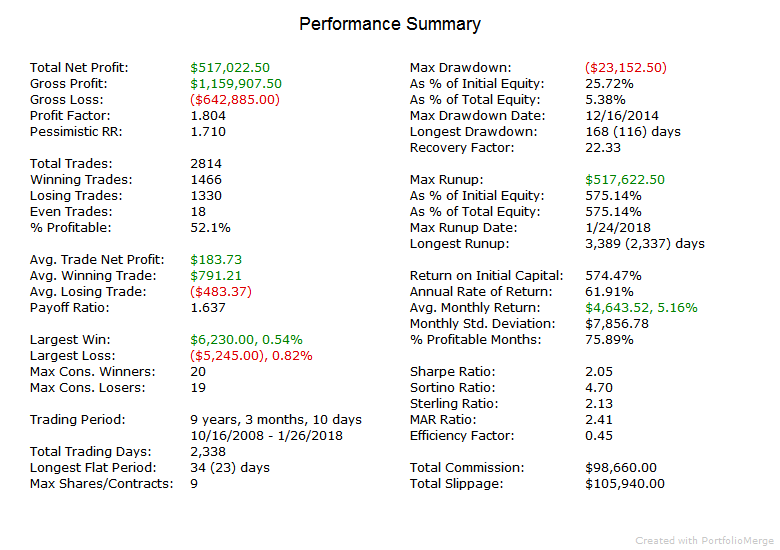

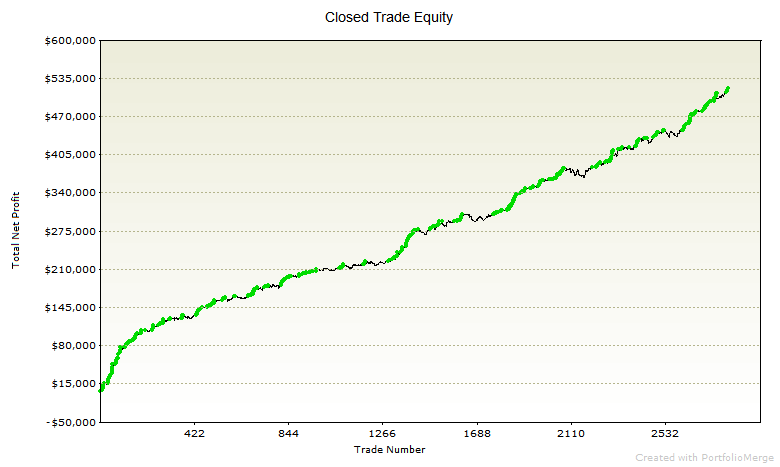

After I send the new strategy code to brokers, I will update the website. In the meantime, here is a sneak peek at hypothetical performance for SentSwing II ES, SimpleSwing ES, Index Swing 6 and Index Trader V. Past performance is not necessarily indicative of future results. Summary and equity graphs below, full reports in this zip file: Sneak Peek

SentSwing II ES

SimpleSwing ES

Index Swing 6

Index Trader V

Russell 2000 switch from TF to RTY

Since the emini futures rollover from September to December a couple of weeks ago, the majority of volume for Russell 2000 futures has moved to the RTY (CME/Globex) from the TF (ICE/NYBOT). I have updated the strategy code to allow trading on the RTY, and all brokers should now be trading RTY for Trendfinder’s Russell 2000 systems.