Updating the Portfolios – February 1 start date

For a couple of reasons, I have explored updating the systems used in the Portfolios. The first reason is that FedSwing II hasn’t had many trades because of current FOMC monetary policy (specifically with their open market account). Their actions have become more neutral to the market and have not provided much edge for FedSwing II to exploit. The second reason is that we now have another swing system (SentimentSwing) that can be used. SentimentSwing uses edges that are very different from the other systems and should be a great fit in the Portfolios.

The number crunching confirmed what I was hoping to see – the updated combinations of systems shows more consistency over time and even more profit (especially for the last two years). For the updated Portfolios, SentimentSwing has been added, the original FedSwing has been put back in, and FedSwing II has been removed. With the new combinations, no system trades more that 2 markets in any Portfolio – this helps risk management and diversification.

The following Portfolios are suggested combinations, and the ones that will be traded for clients that are subscribed to one of these Portfolios starting February 1. If there is any other combination you would like to trade and/or see performance results for (or you don’t want these updates), please let your broker know or email me (gary at trendfindertrading.com). The updated composition for each Portfolio is below (there will continue to be A and B versions as well):

Index Swing 2

MeanSwing II EMD, SentimentSwing ES

Index Swing 3

FedSwing ES, MeanSwing II EMD, SentimentSwing ES

Index Swing 4

FedSwing ES, MeanSwing II EMD, SentimentSwing ES, SentimentSwing NQ

Index Swing 5

FedSwing ES, MeanSwing II EMD, MeanSwing II ES, SentimentSwing ES, SentimentSwing NQ

Index Swing 6

FedSwing ES, FedSwing TF, MeanSwing II EMD, MeanSwing II ES, SentimentSwing ES, SentimentSwing NQ

Index Trader I

SentimentSwing ES

Lion II Vol

Index Trader II

MeanSwing II EMD, SentimentSwing ES

Leopard Vol, Lion II Vol

Index Trader III

FedSwing ES, MeanSwing II EMD, SentimentSwing ES

Leopard Vol, Lion II Vol, Tiger Vol

Index Trader IV

FedSwing ES, MeanSwing II EMD, SentimentSwing ES, SentimentSwing NQ

Leopard Vol, Lion II Vol, Lion III Vol, Tiger Vol

Index Trader V

FedSwing ES, MeanSwing II EMD, MeanSwing II ES, SentimentSwing ES, SentimentSwing NQ

Jaguar Vol, Leopard Vol, Lion II Vol, Lion III Vol, Tiger Vol

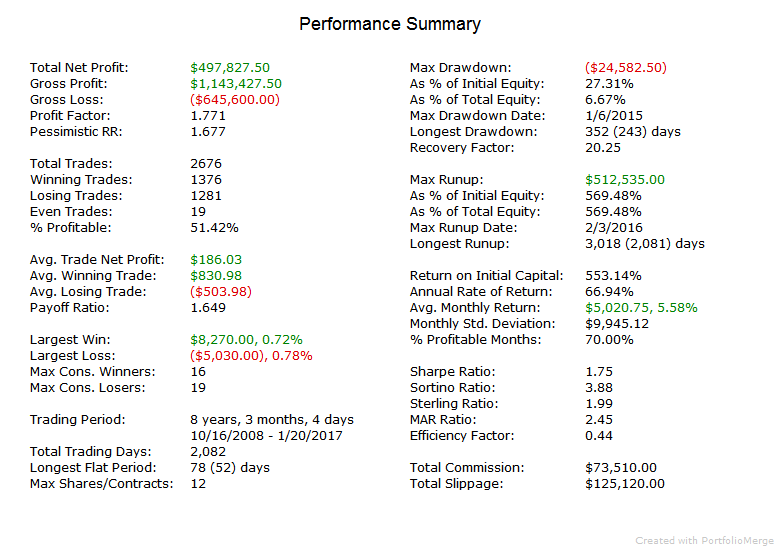

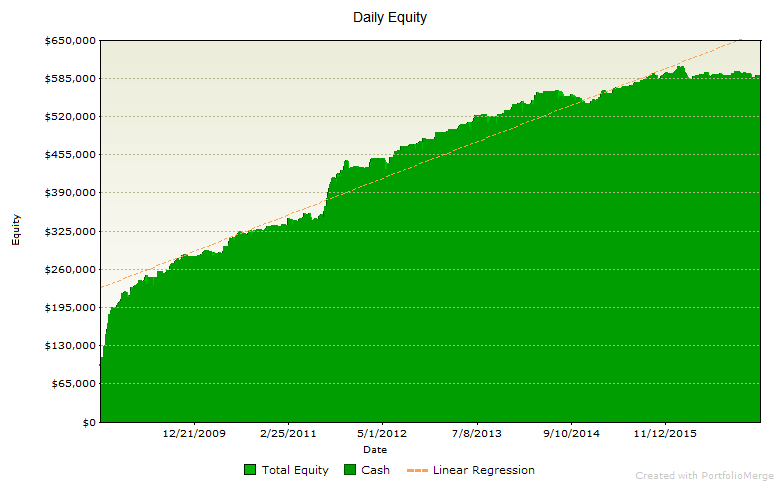

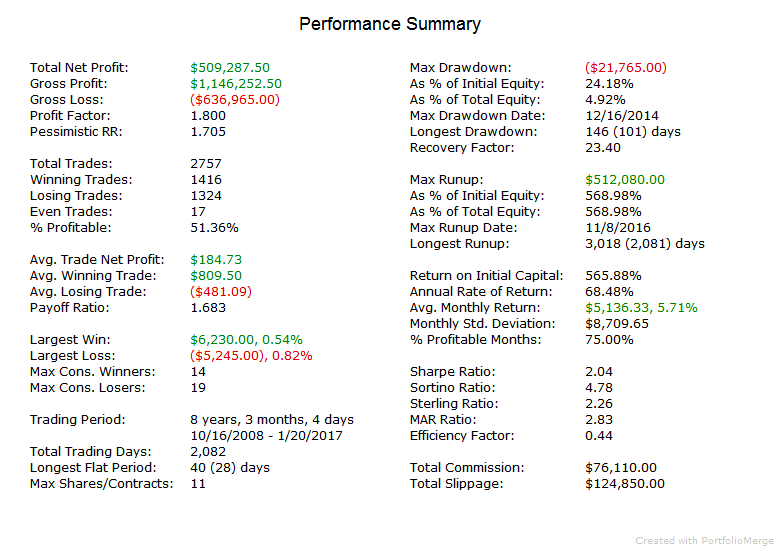

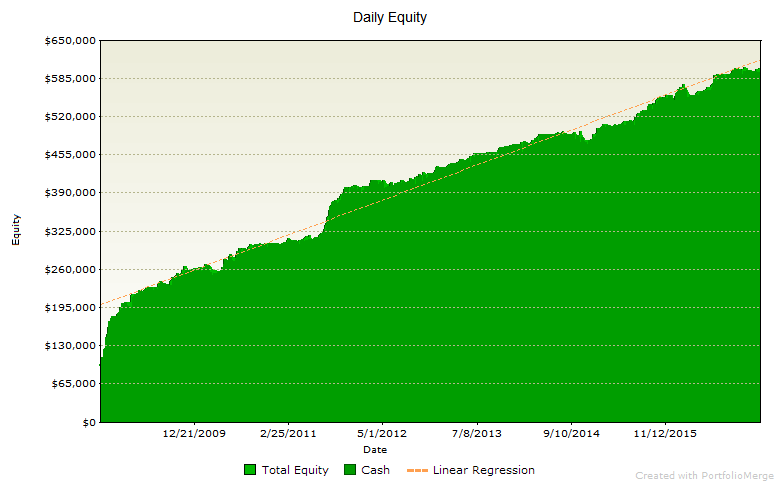

I am in the process of updating the website and will have it completed at the beginning of February. The earliest date for all symbols used is 4/8/2008. This symbol is used for SentimentSwing, and since SentimentSwing needs just over 6 months of data in TradeStation to run, the starting date for all Portfolio backtest results is 10/16/2008. For an apples-to-apples hypothetical backtest comparison of the existing and new Index Swing Portfolios, click Index Swing Portfolio comparisons. For the Index Trader Portfolios, click Index Trader Portfolio comparisons. As an example, comparisons for Index Trader V are below. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Current Index Trader V

FedSwing II EMD, FedSwing II ES, FedSwing II TF, MeanSwing II EMD, MeanSwing II ES

Jaguar Vol, Leopard Vol, Lion II Vol, Lion III Vol, Tiger Vol

New Index Trader V

FedSwing ES, MeanSwing II EMD, MeanSwing II ES, SentimentSwing ES, SentimentSwing NQ

Jaguar Vol, Leopard Vol, Lion II Vol, Lion III Vol, Tiger Vol