Spring ES – a new day trading system

I am always testing ideas for new trading systems. After the sharp drop in February this year, I put my focus on day trading systems. Although not guaranteed, it appears that the extremely low volatility we’ve had in recent years is unlikely to repeat anytime soon. The markets will probably have more typical volatility, and therefore will be more accommodating to intraday systems. I will be releasing more intraday systems over the next few months and revising the portfolios.

Spring ES is a day trading system for the emini S&P 500 futures. The strategy identifies when the market is likely to spring out. It enters with a market order and uses an initial stop, a trailing stop or end of day to exit. It was developed with walk forward analysis which reduces the chances of over fitting and allows the system to adapt to future market conditions.

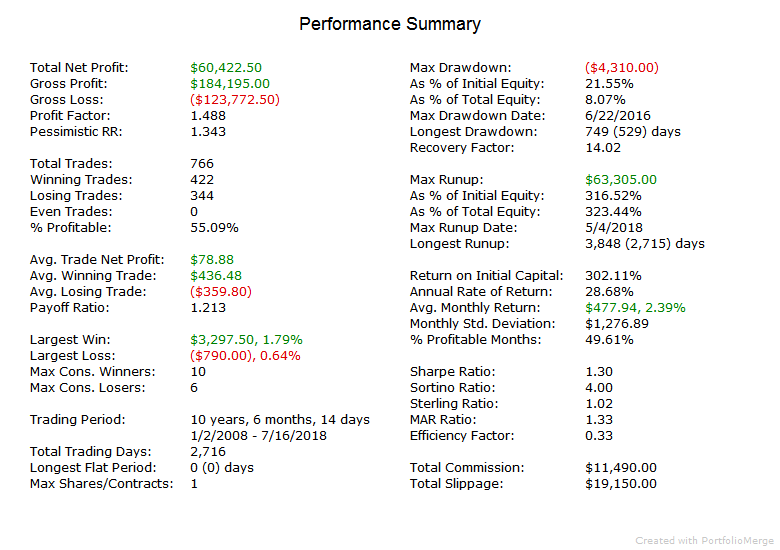

It performs well in volatile markets, including February and March this year. Hypothetical performance is shown below and at the webpage: http://trendfindertrading.com/springES.html Past performance is not necessarily indicative of future results.