FedSwing II walk-forward update

Now that we have had almost 2 years of post-QE Fed activity (US quantitative easing ended in October 2014), I looked at how FedSwing II has matched with the Fed’s actions and impact on markets. When I created FedSwing II in November 2014, I attempted to design the system to best fit the FOMC’s stated policies going forward. There were two methods of analyzing their actions I found to perform well, and I chose the more conservative version to use in the strategy. Now that we have almost 2 years of data to analyze (plus back to 2006), I find that version to be too conservative, and that the other method is a better fit. This is a fairly minor adjustment, but it has shown to provide much better trading results.

Starting 9/23/16, FedSwing II will use the updated method of analyzing the FOMC’s actions. This will be applied as a walk-forward update to the system. In the future, if the FOMC changes policies/guidance, then I may make future walk-forward updates at that time. To show comparative performance results of the method being used going forward, I am showing summaries below for ES and TF along with full performance reports for all markets.

Past performance is not necessarily indicative of future results.

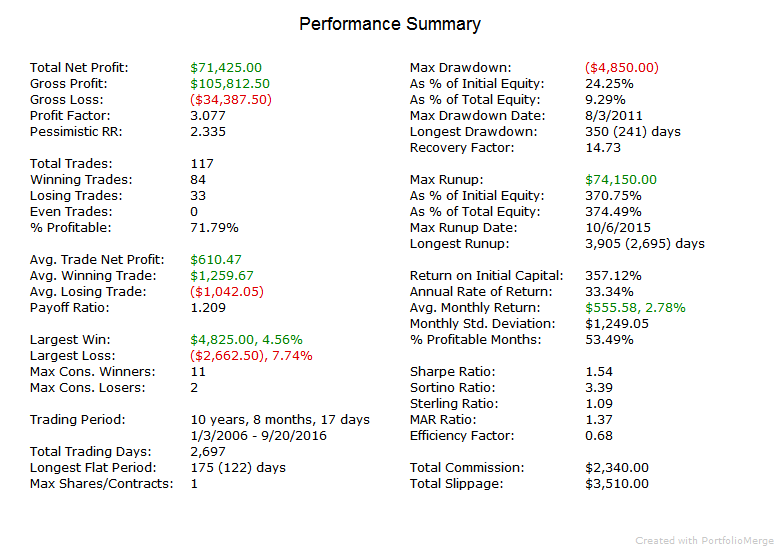

FedSwing II ES old (version ending today):

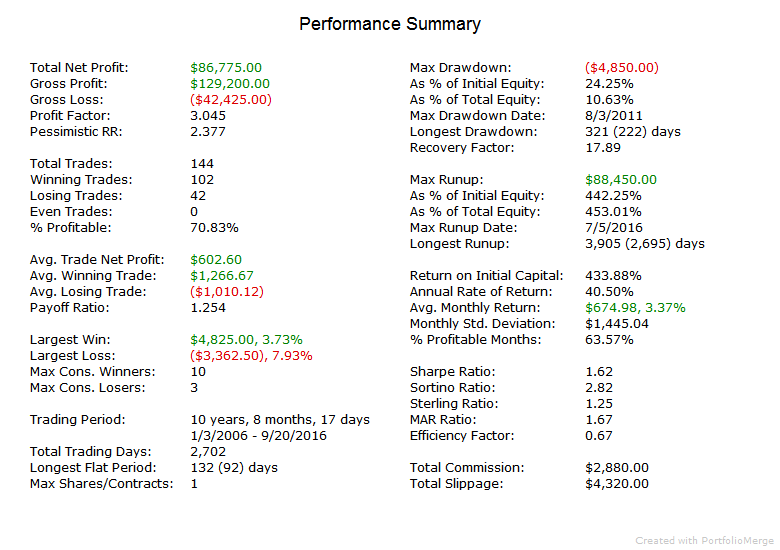

FedSwing II ES new (version starting tomorrow):

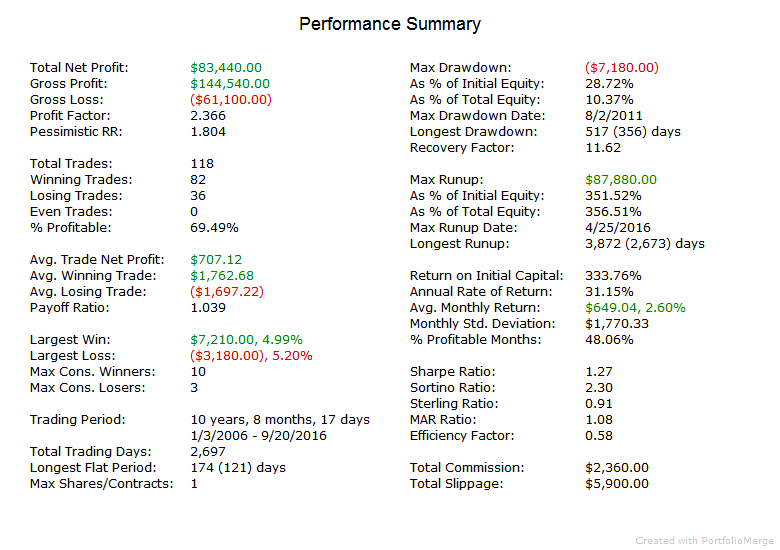

FedSwing II TF old (version ending today):

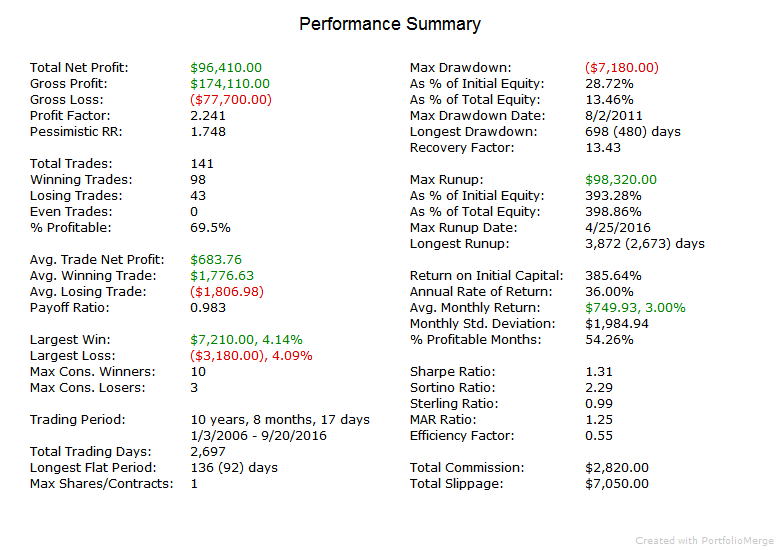

FedSwing II TF new (version starting tomorrow):

Link to zip file containing full hypothetical performance reports for all markets: http://bit.ly/2cV5YPl