FedSwing II performance comparisons

FedSwing II has been released. FedSwing II incorporates the Fed’s open market account holdings. This additional filter reduces net profit historically, but more importantly it also reduces drawdown. In my opinion FedSwing II is better suited to FOMC policy, especially going forward, because it incorporates the balances of the FOMC’s open market holdings. Per the October FOMC statement where they announced the end of QE, they also stated that intend to remain accommodative by “reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction.” Translation: even though they are not engaging in new quantitative easing, they are still supporting the market.

Also a break-even type of stop was added because this is one of the most common requests received from clients and does not greatly hinder performance. The other two most common requests are smaller stops and trailing stops (both of which greatly degrade performance so were not added). Although this break-even stop does reduce profit a little, it will protect us from situations where we have a large profit and a price shock occurs.

Effective yesterday (11/24/14) all portfolios are using FedSwing II instead of FedSwing. Clients may continue to trade FedSwing on individual markets or switch to FedSwing II. To switch please contact your broker (may need to sign paperwork) and let me know so I have an accurate count. Please note FedSwing II will NOT be offered as an individual system for EMD because liquidity is too low.

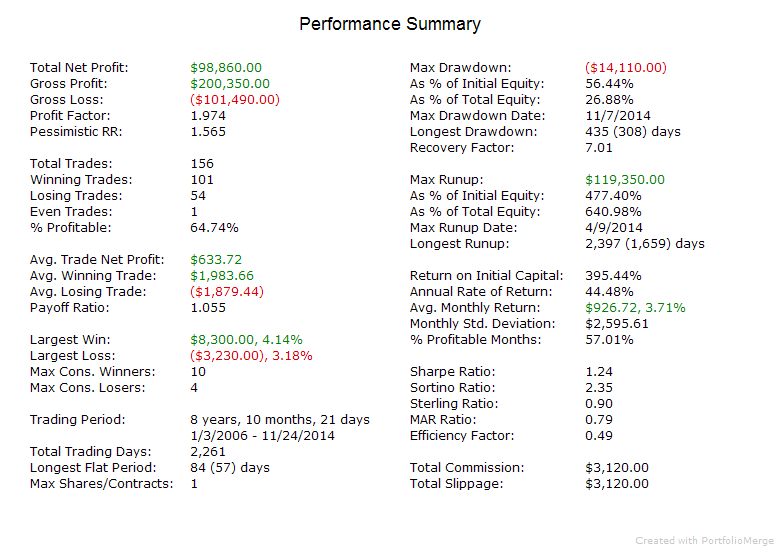

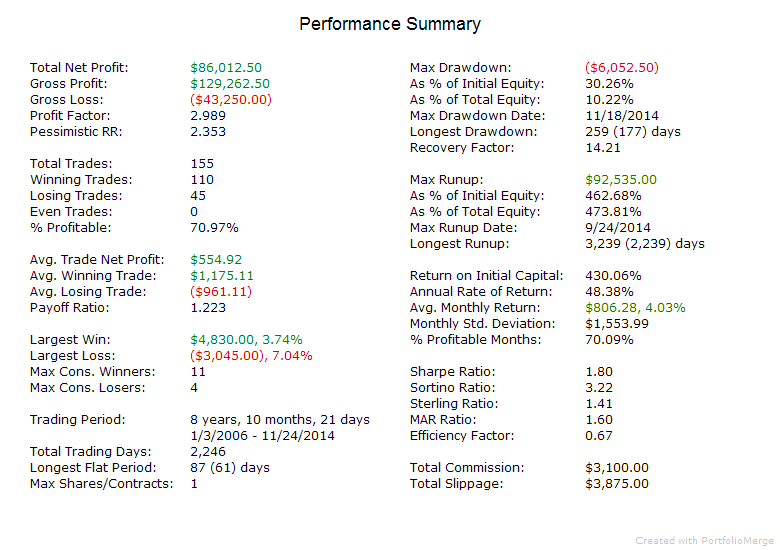

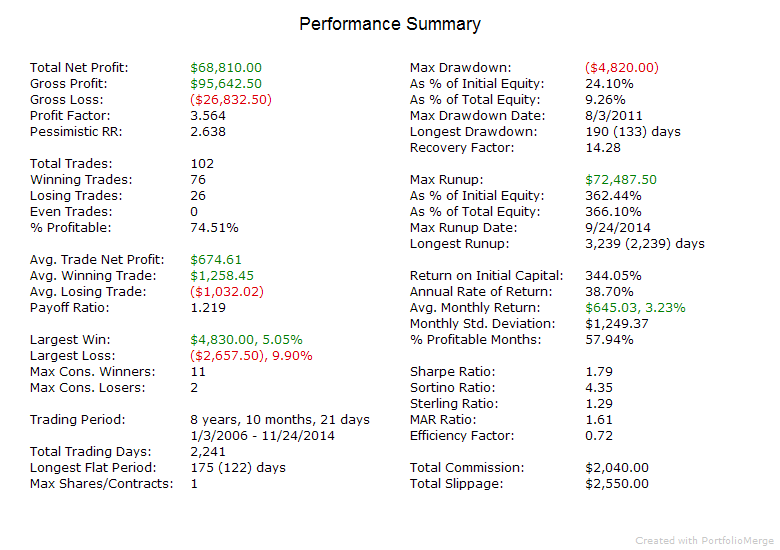

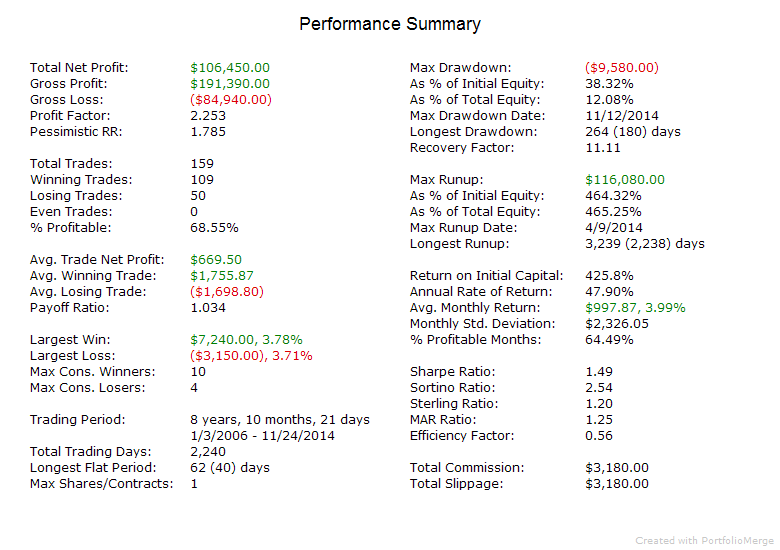

The performance reports following use the current version of FedSwing (with revision made in early October) applied to all data to give an apples to apples comparison going forward. For the Index Trader portfolios I used the current version of the Vol systems for all past data for the same reason. All hypothetical performance below includes $20 roundturn commission and 2 ticks roundturn slippage (3 ticks roundturn slippage for intraday systems). Reports were created going back as far as possible for systems used (FedSwing can go back to 1/1/06, Vol systems can go back to 1/1/07) so you can see as much info as possible. Below are summaries for FedSwing, FedSwing II, Index Swing 6 Portfolio and Index Trader V Portfolio. For full reports of all systems and portfolios, please download this zip file: Reports

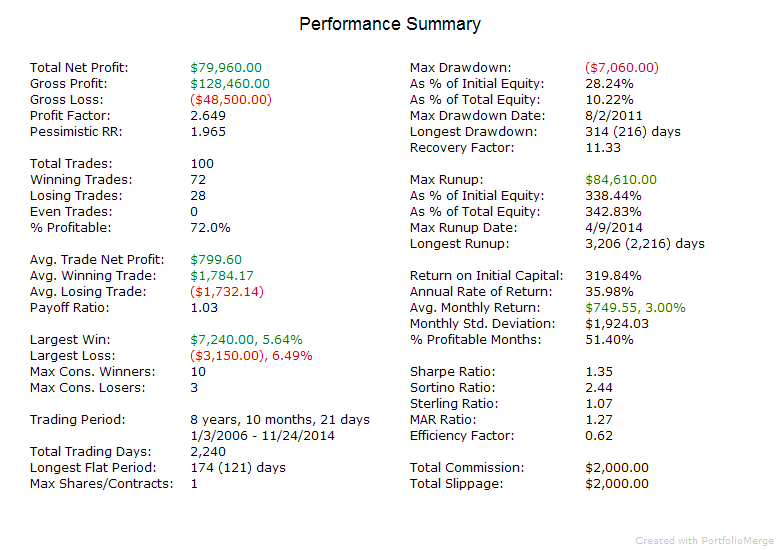

FedSwing EMD current

FedSwing II EMD

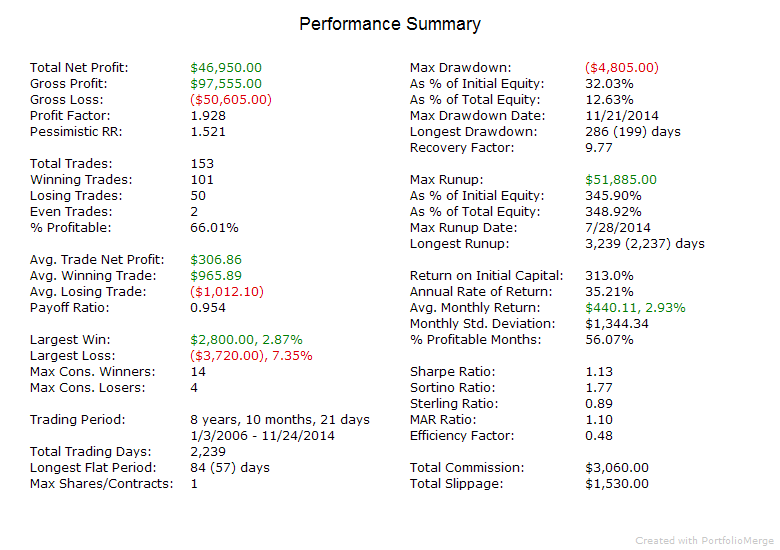

FedSwing ES current

FedSwing II ES

FedSwing TF current

FedSwing II TF

FedSwing YM current

FedSwing II YM

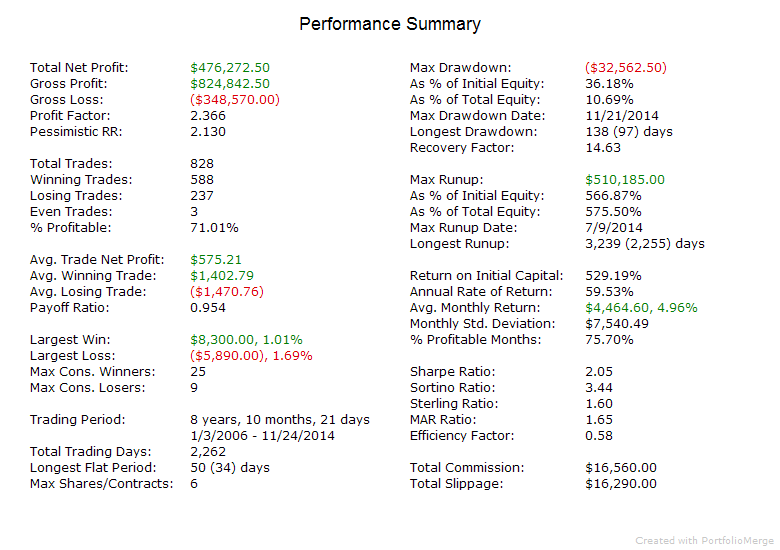

Index Trader V current

Index Trader V with FedSwing II

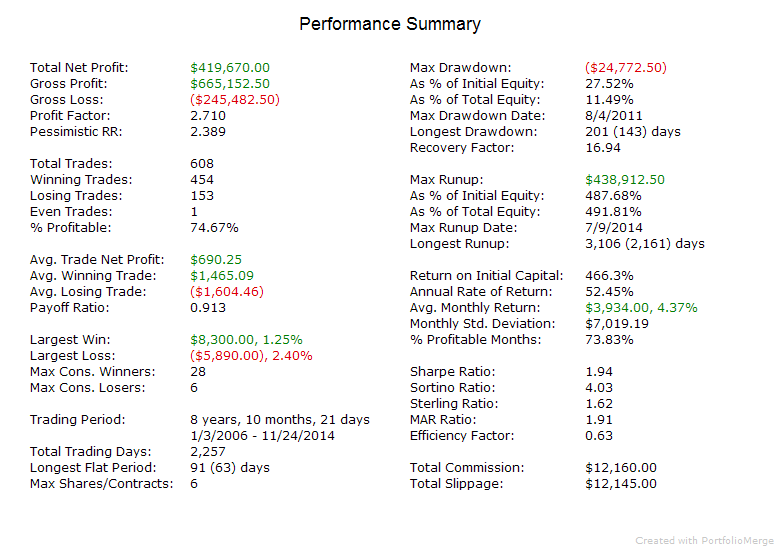

Index Swing 6 current

Index Swing 6 with FedSwing II

For full reports of all systems and portfolios, please download this zip file: Reports

Next week I will update the website for FedSwing II and updated portfolios.

[…] All portfolios now use FedSwing II instead of FedSwing. This is because I think FedSwing II much better tracks the activity of the FOMC and will therefore provide better performance going forward. For comparisons of FedSwing to FedSwing II please see this blog post. […]