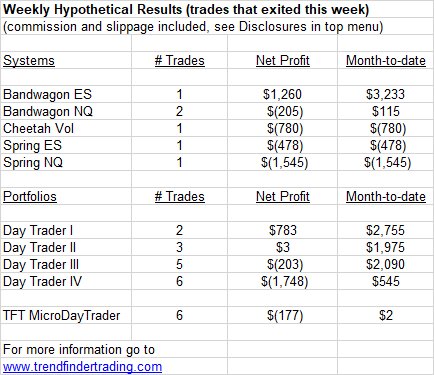

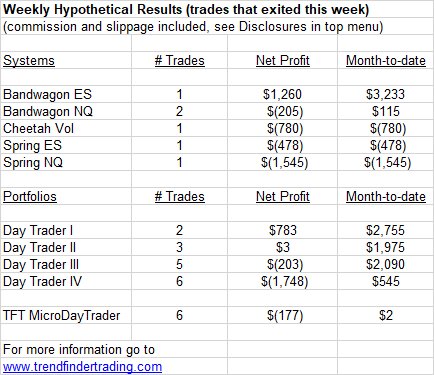

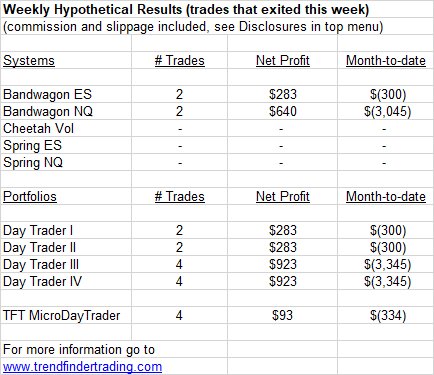

Weekly Results – week ending 9/22/23

Mixed bag this week. If volatility continues to rise then the other trading systems will be active also.

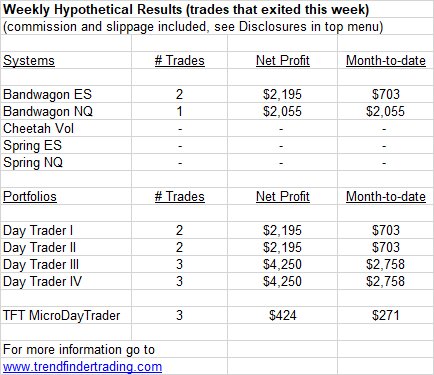

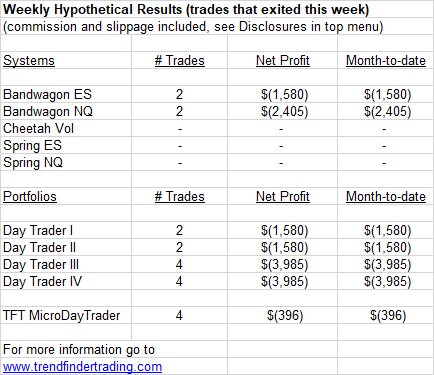

Weekly Results – week ending 8/4/23

Trendfinder’s emini futures trading systems did not have any trades this week.

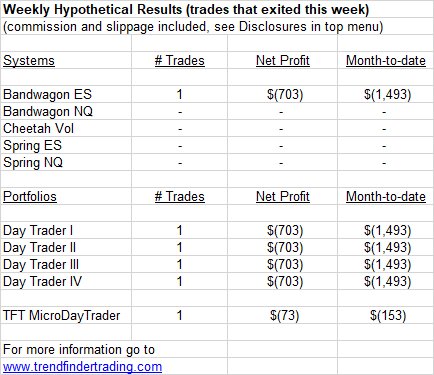

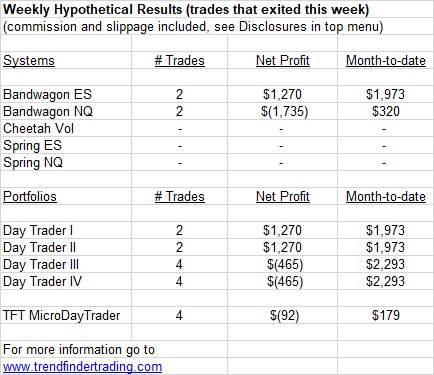

Weekly Results – week ending 7/28/23

Trendfinder’s emini futures trading systems did not have any trades this week. They are still waiting for volatility to return.