Futures Truth Interview & Systems Rankings

I was interviewed by Futures Truth, and it was published in their latest issue (4th Quarter 2013). Here is a link: Futures Truth Interview

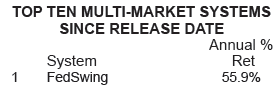

In this Futures Truth issue, FedSwing was ranked #1 for “Multi-Market Systems Since Release Date”:

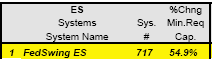

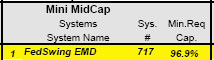

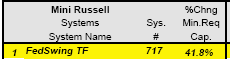

FedSwing was also ranked #1 for each stock index they track (for results since release date):

MeanSwing II was #9 for the ES, #5 for the EMD, and #12 for the TF in the same category.

Futures Truth hypothetical percentage returns are based on “Min. Req. Cap.” which they calculate as 5 times Margin. Returns include $25 round turn for commission and slippage per trade. Please see Futures Truth magazine for more information.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

THERE IS A SUBSTANTIAL RISK OF LOSS IN FUTURES TRADING. THE HIGH DEGREE OF LEVERAGE THAT IS FOUND IN FUTURES (BECAUSE OF SMALL MARGIN REQUIREMENTS) CAN WORK FOR YOU AS WELL AS AGAINST YOU, I.E. YOU CAN HAVE LARGE LOSSES AS WELL AS LARGE GAINS.